Lost luggage: insurance, and how to find your luggage. Air baggage insurance Airport baggage insurance

Updated 02.02.2020 Views 3715 Comments 11

Luggage insurance is not as obvious a necessary thing as, for example, regular travel insurance, but it can come in handy, because the loss of luggage is a rather unpleasant thing and at least some compensation can brighten up this situation. Usually luggage is insured if they fly by plane, but you can insure using another mode of transport, it's just less common.

Why do you need luggage loss insurance?

In the case of air travel, the carrier airline is responsible for your luggage. And she is obliged, in case of loss or damage to luggage, to pay compensation for each kilogram of weight in accordance with the Warsaw Convention. But the maximum payout is quite small.

When buying luggage insurance, the amount received can be much higher. Of course, the airline will still pay compensation, and the insurance company will deduct its amount from its insurance payment, but it will turn out to be more profitable in the end. On the other hand, if you do not carry more or less valuable things in your luggage, then perhaps the compensation from the airline will suit you, because shorts and T-shirts are inexpensive almost everywhere and in general you can score on their loss. However, if luggage is obviously valuable (for example, I have a tripod there, chargers for various devices, expensive shoes), then it makes sense to insure luggage with an insurance company.

Thus, having luggage insurance, if you lose it, you will receive more or less real compensation. By the way, you can also insure the delay of luggage, because it happens that luggage is lost, but it is found a day later, and these days you have to somehow get out by buying hygiene items and at least some clothes.

Where can I buy

Basically you have 3 options.

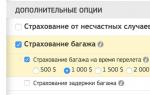

1. Luggage insurance is most often bought as an additional option to regular travel insurance. That is, they chose the main insurance and added an option for luggage. The matter is voluntary. The cost is quite small, and often the option is already included in the insurance by default. How to check and add? Go to my favorite, check the box, choose the sum insured for luggage and see the filtered results. You can also check the "baggage delay" checkbox. .

Baggage insurance option on Cherehapa

2. Probably the most unpopular option is to buy a separate luggage insurance. You can do this, both at some specific insurance companies, and again at Cherehapa. Set all the parameters (country, dates) and then check the "Luggage insurance" checkbox, and uncheck the "Medical insurance" checkbox. True, there will be very few filtered results, since few people offer such insurance as a separate product.

Purchasing separate baggage insurance

3. During the purchase of an air ticket, almost all online agencies that sell you an air ticket will also obsessively offer you to buy luggage insurance (as well as other options). Remember, you don't need to buy baggage insurance a second time if it's already included in your main travel insurance. And I strongly do not recommend buying basic travel insurance from these agencies, they will not offer good ones.

Terms and conditions of insurance

Baggage is considered lost if it has not been found within a certain number of days. Usually found during the first day and can even be brought to the hotel. If the baggage is not found in the end, then an insured event occurs. Insurance companies usually consider such cases for a long time, so you may first be compensated by the airline after it admits that the baggage was indeed lost to it. I repeat, the insurance company will deduct from its payment the amount already paid by the airline.

When purchasing baggage insurance as an additional option, you can sometimes choose the cost (estimated) of your baggage yourself. The sum insured ranges from 500 to 2500 USD/EUR. This is the maximum amount in case of complete loss, in case of damage to luggage, compensation will be paid only for damaged items, and it also depends on how much damage can be proved.

Sometimes baggage insurance is already included in your travel health insurance by default, if it's good and not the cheapest insurance. You need to look at specific insurance programs. Other options may also be included.

Some bank card holders (usually premium cards or credit cards) have their own annual travel insurance with a limit on the number of days or trips. And these insurances may also include luggage insurance. Check with your bank that issued the card for details. But usually only the loss of baggage is insured, the delay in baggage delivery is not insured. And, for example, in order for insurance on the Avangard bank card to start operating, you must either initially pay for the ticket with their card, or buy something in the duty free at the airport of departure, and this is important just in the case of luggage.

Some nuances.

- If baggage insurance is an option to the main insurance, then you need to know this. The validity of baggage insurance starts from the moment you drop off your baggage at the airport, so this calendar day (day of departure) must also be included in your main insurance. It's just that some save on one day, buying insurance from the next day after the day of departure. In this case, you don't need to do that. The same is true when you return home - travel insurance expires at 12 midnight on the day the contract ends, so if the flight is delayed or the plane is late, the insurance may end. Therefore, it makes sense to buy insurance for one day longer than the trip.

- A standard luggage insurance contract usually provides for compensation in case of loss or damage during transportation or as a result of sudden force majeure: natural disasters, fire, robbery, robbery, traffic accidents, terrorist attacks, strikes and military operations. Insurance is not paid in case of damage by rodents or through the fault of the passenger, as well as in case of confiscation of baggage.

- Luggage can be insured both for the duration of the flight and for the entire duration of the trip, but only on condition that it is stored at the hotel, in the luggage room. What you carry with you will not be refunded if damaged or lost.

- Some insurance companies use an unconditional deductible when insuring luggage. This is a fixed amount or a percentage of the sum insured that is not compensated. If the damage to you is less than this amount, no compensation will be paid. For example, if the deductible is $15 and the damage is $10, then no compensation is paid. If the damage is more than this amount, then you will receive monetary compensation minus the deductible.

- Separately, only luggage is rarely insured. Unless these are particularly valuable things such as antiques, but in this case they make up a separate insurance contract and this is another topic that we will not touch on now.

Airline reimbursement (airport insurance)

As I already wrote, you can simply use the reimbursement from the airline, in fact, also insurance. But the amount will be small, in accordance with the company's standard rates for 1 kg of luggage. And no matter how valuable your baggage is, the airline has a maximum amount for payments, you won’t be able to get more.

For example, Aeroflot is not responsible for minor damage to luggage, and in case of damage to the contents or loss, it pays $ 20 per 1 kg of weight. But this is ideal, because you will have to prove the value of things, and everything depends on whether they agree with you.

There is another option. If you have something of value in your baggage (such as a quadcopter), you can check your suitcase at the check-in desk as insured baggage. That is, you declare in advance the items contained in your luggage and write their value in the inventory. But the airline usually takes an additional fee for valuable baggage, about 5-10% of the declared value, and also require receipts for high costs. So buying luggage insurance from an insurance company can again come out cheaper. And given that this whole procedure with the registration of valuable luggage is quite long (you need to arrive early in order to have time to declare luggage), then again, it’s easier to buy insurance, it’s done in 2 clicks.

Insured event with luggage

What to do

- In case of loss or damage to luggage, the first thing to do is to draw up a PIR report (property irregularity report) at the Lost and Found counter. Without a PIR number, you will not be able to receive compensation later. After drawing up the act, you should be given a written confirmation and registration number.

- Keep your air ticket, boarding pass, baggage receipt. The entire list of documents required to receive material compensation must be obtained from the representative of the airline.

- Contact your insurance company immediately and receive instructions from an assistant. When calling, you must provide the name, policy number, place where the insured event occurred.

- In the Lost and Found service, you need to write a statement about the loss or damage, with an inventory of things. If your luggage is lost or damaged, you must make a statement about this no more than 24 hours after the incident. First, a protocol is drawn up with airport employees to record the fact of what happened.

- The carrier's representative must draw up a statement of loss or damage. If he refuses to do this, you need to take a written refusal from him. After arriving back to your homeland, you must provide the protocol and other documents to the office of the insurance company.

Do air passengers need luggage insurance at all? If in the situation with medical travel insurance everything is quite clear (without insurance you will not be issued a visa to Europe, and you should not risk being left without medical care abroad), then luggage insurance is a purely voluntary matter. Your things - you decide how much they are dear to you and how to deal with them. But since insurance companies offer such a service, it means that someone needs it. We will figure out how to insure luggage, how much it costs and whether it is worth it.

The first thing you should know is that the carrier airline is responsible for your luggage during the flight. According to the Warsaw Convention, if your baggage is lost, the airline will pay you compensation in the amount of 15 to 25 dollars per kilogram of weight. We carry out a simple mathematical operation and see that the maximum compensation for a standard suitcase weight of 20 kg will be $500. Well, if your things together with a suitcase cost about that much. And if only a suitcase costs $500? And in the suitcase is also a dress from Chanel, which weighs 300 grams and costs under a thousand euros? And a couple more similar outfits. Will you be satisfied in this case with compensation from the airline? Hardly. For such cases, luggage insurance is issued.

How to insure luggage

As a rule, baggage is not insured separately; exception - furs, jewelry, antiques, securities - in order to insure these items, a separate contract is drawn up. Usually baggage insurance is included as an additional option in an extended contract or purchased together with travel medical insurance.

You can insure your baggage only for the duration of the flight or for the entire duration of the trip. Please note that if your handbag was snatched from your hands, then this is not considered an insured event - insurance only applies to luggage checked in at the airport or stored at the hotel, provided that you did not leave it unattended in the corridor.

When buying insurance, you yourself determine the total cost of your belongings and indicate this amount in the contract. The minimum amount of insurance compensation is 1000 dollars or euros (depending on the company). The maximum amount also depends on the specific insurer, for example, Alfastrakhovanie offers insurance from 1000 to 1500 euros, Allianz - from 1000 to 2000, and the most "generous" Ingosstrakh - up to 5000 euros. You can insure your luggage for such amounts at the same time as purchasing medical travel insurance online.

As already mentioned, valuable luggage is insured according to a different scheme. First, you must provide the insurance company with an inventory of the things you are taking with you and indicate their value (you may be asked for receipts). Secondly, you will be required to store these valuables properly - in a safe, in a special wardrobe or a lockable luggage room. If they were stolen, then you will need to provide the insurance company with documents confirming the correct storage.

Insurance conditions

A standard luggage insurance contract usually provides for compensation in case of loss or damage during transportation or as a result of natural disasters, fire, robbery and robbery, traffic accidents, terrorist attacks, strikes and military operations.

Compensation is NOT paid in case of careless and negligent attitude of the owner; if it was recorded that he was in a state of alcohol or drug intoxication, in the event of radioactive contamination or exposure, if your belongings were confiscated and if the luggage was damaged by rodents.

Almost all insurance companies use an unconditional deductible when insuring luggage. What it is? This is a certain amount (fixed or percentage of the sum insured) that is NOT compensated. The most common option is an unconditional deductible of $50. This means that if the damage to your baggage was $50 or less, then you will not receive compensation. If the damage was more than $50, then you will receive monetary compensation, from which the deductible amount will be deducted.

Another condition that is often not taken into account by insurance buyers: if you received compensation from the airline, then this amount will also be deducted from the amount of insurance compensation.

The insurance begins to operate on the day specified in the contract, from the moment of crossing the border (border control) or checking in luggage to the carrier. The insurance expires at 24.00 on the day the contract ends. At this point, pay attention - if you have a late arrival, and the plane is late, then in case of loss of luggage, insurance will not help you, as it will expire. We recommend purchasing travel insurance that is valid for one day longer than the trip.

How to get compensation

If your suitcase is lost on the way to your vacation, or things are hopelessly damaged, you should immediately contact the assistance (service center) of your insurance company - they will tell you what you should do. In any case, first you will have to contact the local service Lost and Found, write a statement about the loss and make an inventory of things. You must file a claim within 24 hours of the loss.

Under no circumstances should you throw away or give your baggage receipts to anyone (usually they are glued to the cover of your passport or ticket), you will need them to receive compensation.

Baggage is considered lost if it is not found within 14 days, so don't expect your insurance company to refund you immediately. The airline can do this, but only to the extent of a small amount that you can use to buy basic necessities; usually this amount does not exceed $50 and is paid solely at the discretion of the airline.

To receive compensation, the tourist must write an application to the insurance company within a month from the date of return from the trip. The application shall be accompanied by an act of loss or damage to luggage, baggage receipts and documents on receipt of compensation from the airline (if any). Within 15 days from the date of submission of the application to the insurance company, the tourist will receive monetary compensation.

How much does luggage insurance cost

The cost of insurance depends on the duration of the trip and the country of departure. In order for you to roughly orient yourself, we provide a table that shows the cost of insuring 1 piece of luggage when flying to Schengen countries for a week with insurance companies that are SaleTrip partners:

As you can see from the table, you can take out baggage insurance for the duration of the flight with compensation of 1500 Euros in all insurance companies. The insurance service at the hotel is provided only by Allianz - for 1144 rubles. you can insure luggage for the duration of the flight for 2,000 euros, and at a hotel for 1,000 euros, for a total of 3,000 E. Well, you can receive the maximum compensation in case of loss at Ingosstrakh - up to 5,000 Euros.

We remind you that take out an insurance policy you can online directly on our website. Before you buy insurance, be sure to read the contract - remember that by purchasing insurance, you automatically agree to all the conditions.

Article author: Katya Kim

I travel and write about travel. I don’t use the services of travel agencies, I don’t like sights that everyone “must visit”, I don’t talk about “resorts with developed infrastructure”. I share my experience on how to travel on my own.Going on a trip abroad, experienced tourists without fail buy a health insurance policy in order to protect themselves from unforeseen financial expenses in case of force majeure. What about personal belongings and luggage insurance? Is it necessary to purchase luggage insurance and how to do it?

Why do you need luggage insurance?

Luggage insurance is designed to protect you from financial losses in case of loss of your personal belongings. Baggage can be lost at the airport, during loading / unloading of the aircraft, when transferring in another city, etc.

In addition, we all know how “carefully” forklifts handle passenger bags. It hurts to watch. Damage to things is an extremely offensive and common phenomenon, and try to prove to the airline that it is she who is guilty of the loss and, moreover, damage to your property. Luggage insurance is needed in order to compensate for your losses in the event of an insured event.

“And how much will I be paid for damaged or lost things?”

You are probably aware that the airline you are flying with is responsible for your personal belongings during the flight. In case of loss of baggage (at the airport, during loading or unloading, during transfer, etc.), the carrier will pay you compensation. As a rule, it is 15-25 US dollars per 1 kilogram of the weight of a suitcase/bag/backpack.

Well, if this amount covers the cost of all your lost things. But what if you also have a pair of Louboutins, a Chanel clutch or other designer items worth thousands of euros in your suitcase? It is unlikely that such compensation will satisfy you ...

But when applying for insurance, you yourself determine the total cost of your things and indicate it in the contract. The minimum sum insured will be 500 USD. At your discretion, you can increase it up to 2500, and in some cases even more.

“And if I bring very valuable things with me, can I insure them separately?”

As a rule, for most customers, a regular luggage insurance will be sufficient. You can insure jewelry, fur, antiques, securities, but this is a separate type of insurance.

“What is and is not an insured event?”

The "standard" contract involves the payment of compensation for:

- loss of luggage;

- damage to luggage during transportation;

- loss and damage to luggage during natural disasters, fire, robbery, traffic accident, terrorist attack, military operations, etc.

The insurer will not pay you compensation if you yourself were careless with your things (for example, you left your bag unattended). In the event that alcohol or drug intoxication of the insured person is recorded, no payments will be made. Also, compensation is not provided for when luggage is confiscated or damaged by rodents or insects.

What you should pay special attention to when choosing insurance

Specify whether a deductible is used - the amount of damage that the insured compensates at his own expense, and the insurer is exempt from paying the amount established by the deductible.

To understand what a franchise is - consider an example: the franchise is indicated in the amount of 50 USD, on a trip you lost your purse with things worth 49 USD. In this case, you will not receive compensation. In case of loss of luggage in the amount of 290 c.u. you can count on a refund of 290-50 = 240 c.u.

Another important point. If the carrier airline paid you some compensation for damaged or lost baggage, the insurance company, in compensating your losses, will deduct from the payment the amount that you received from the airline.

Remember that the carrier in case of loss of luggage will pay you only $ 20 per 1 kg of weight. And that was only three weeks later. Not a very rosy situation, which is also overshadowed by the fact that domestic airlines are extremely reluctant to meet the owners of things, constantly delaying payments. And low-cost airlines (and even Russian ones) are completely special.

"How does insurance work?"

The validity of the insurance starts from the day specified in the contract, from the moment of crossing the border or handing over the luggage to the carrier. The expiration date is exactly at midnight on the day the contract ends.

This is an important point, because if suddenly your plane is late, or a late landing is planned, and your luggage is lost, insurance will no longer help you! It is recommended to buy a policy that is valid for one more day after your return.

"How can I get compensation?"

So, let's imagine that a terrible thing happened: your luggage was lost or irreparably damaged. What to do?

First, you must immediately call the insurance company from which you purchased the policy, the operator will coordinate your further actions.

Contact your local Lost and Found service, write a missing person's report with a list of things. The application must be submitted within 24 hours of the loss.

And be sure to keep your luggage receipts! They are required to receive compensation.

"And how long do I have to wait?"

Alas, no one will return anything to you right now. Baggage is considered lost only if it has not been found within 14 days.

The airline can refund you immediately, but only within a very small amount - about $ 50, so that you can buy yourself what you need for the first time. And even then, not every airline pays such compensation.

To receive money, you must:

- within a month from the date of return, write an application to the insurance company;

- attach to the application an act on the loss/damage of luggage, luggage receipts;

- if you received compensation from the airline, please attach these documents too.

Within two weeks you will receive monetary compensation from the insurance company.

Choosing a "site", you make a choice in favor of the most reliable, responsible and trusted, which means you go on an unforgettable journey without any worries!!

Only on KONTI any insurance policy with a 20% discount using the promo code 000750396

Hello, how many flew, always insured. For what? I don't know, just to be! So, in the course of the Transfer, the disgusting company MAY (Ukraine) did not have time to transfer my luggage to the plane and we flew away without it. At the point of arrival, about 15 people found themselves without luggage, of which only 3 were insured. A wave of panic, screams and scandals began! Someone came to the wedding and there were dresses and suits for the celebration in their luggage, someone was just angry for no reason. Rather, I was at a loss, turned to a representative of the company, in the same place at the airport. A nice girl said that the luggage could be brought only after 3 days, since this airline returns luggage only by its own planes. I issued a document on the fact of non-arrival (PIR), issued some papers related to customs. And then I saw an insurance policy, it was written in black and white that the amount of compensation for the fact of baggage delay for more than 48 hours is 15,000 rubles, I confess, it warmed my soul.

Then came calls to the Alfa Insurance call center, long, meaningless, for the most part. So the operator said that in addition to compensation of 15000r, I can buy essentials(there is no list of these things, the maximum amount too) and their amount will be reimbursed to me. Next, it was necessary to provide scans of all available documents by mail, said and done. And then the "adventure" began. The first response from the company was:

According to the Rules of the insurance contract (policy) Z694.***** 5891306; Z694.*****.F5891305 at risk "baggage delay" operates throughout the world behind except for the territory located closer than 150 kilometers from the place of registration and/or permanent residence of the Insured.

Thus, if you flew home and your luggage was delayed, then you, even if you were insured, can throw out the insurance - you will not receive anything. I am registered 1280 km from the place of arrival, so I boldly sent the original documents by mail (by registered mail with a list of attachments) to receive the promised compensation. After waiting (about a month). I wrote an e-mail with a request to report the results on my question and received a response:

Your documents have been received and reviewed.

The documents under your insurance contract were submitted for payment on 09/18/2015. Payment term 5-7 business days.

Joyful, I sat down to wait for a notification from the mobile bank about the transfer of funds. On September 22, I received an SMS in which the amount of the transfer was 3966 rubles, I remind you that this amount is for essential goods. I wrote the letter again now with the question: Is this the whole amount? And the answer was vague:

In accordance with paragraph 4 of Section 5 of the Rules, upon the occurrence of an insured event, the Insurer may be reimbursed for expenses Policyholder (Insured) for purchasing essentials within the limit specified in the insurance contract.

You submitted checks for the purchase of essential goods in the amount of 3,966.00 rubles for reimbursement.

Thus, this amount was transferred on 09/22/2015. (p/n 165798).

I got into the rules and started looking for this item:

Section 5. Combination insurance of additional expenses of passengers.

4.1.2 "Luggage delay" - a delay in the delivery of baggage by the carrier, confirmed by the relevant documents of the carrier, in excess of the period established by the insurance contract (...)

4.2.2 According to the risk of "baggage delay"(...)

b) According to option B, expenses for the purchase of essential items within the limit specified in the insurance contract. If such a limit is not specified in the insurance contract, it is recognized as equal to 3,000 (three thousand) rubles. At the same time, unless otherwise specified in the insurance contract, the minimum necessary items of personal hygiene (including childcare) are considered essential items.

That's all the information on this type of insurance. I do not see here confirmation and refutation of payment of compensation to me. And since I'm not a lawyer, I called the representative of the company in my city. Here is what they told me: 15,000 is the limit, if you provided checks for 30,000 rubles, you would only be paid 15 rubles, but you provided for 3966 rubles, so they paid you. I'm probably a chuchmechka, if this amount is a limit, then the word "Up to", that is, the amount of payment "up to 15,000 rubles" should be written in the contract.

Insured or not?

I think that there is a need for insurance if you are flying with a transfer, that is, with transfers, so the likelihood of losing luggage increases. It makes no sense to insure if you are flying home (at the place of registration), no one will pay you anything anyway (this only applies to luggage, health insurance, most likely has its own characteristics). In general, I told you my sad story and pitfalls. Good luck to you!

Going on a long journey, all travelers want to feel as protected as possible. Flight baggage insurance is a must for anyone who wants to protect themselves from trouble.

Money during the flight is not insured

In the contract provided by the insured, this item must be indicated. A separate contract is required for valuables insurance.

Important nuances

Compensation cannot be paid if the owner has been careless or negligent with his belongings. They also refuse compensation when the fact of alcohol or drug intoxication of the owner is easily proved.

Almost all insurers prefer to use an unconditional deductible. It represents a % of the sum insured that is not reimbursed. The most common deductible is $50. This means that if the damage to luggage is less than this amount, then it will not be reimbursed. If the damage is estimated to be higher than $50, then the owner receives compensation, from which the deductible amount is deducted.

If the owner receives compensation from the air carrier, then the deductible amount is also deducted from the amount of insurance compensation.

Luggage insurance is compensation for loss or damage to property.

Basic baggage rules

The table lists the basic baggage rules.

| Kind of transport | Baggage weight | Minimum insurance amount | Maximum amount insured | Nuances |

| Airplane | Up to 30 kg of luggage, including hand luggage. | 1000 $ | 1000-5000 $ for all air carriers. | If a traveler loses his luggage, he is paid from $15 to $25 for each kilogram of baggage weight. |

| Sea transport | Weight is determined independently by each carrier. | — | — | The risk of loss or damage to property is quite low. There are quite strict requirements for packing luggage. |

| Train | Free of charge - up to 36 kg of luggage, including hand luggage. | — | 2000–5000 $ | Luggage transportation by rail is insured quite infrequently, since the risk of its loss is low. |

How to purchase

Travel luggage insurance can be purchased as:

- An additional option to regular insurance.

- Separate policy.

- Ticket supplements.

First way

This method is considered the most popular. To purchase insurance online, you need to select the main insurance for the country you are flying to and add the option for luggage.

The price is quite democratic, and this option is included in the policy by default. Additionally, you can add the option "baggage delay".

These checkboxes must be checked when applying for basic insurance.

Second way

To purchase insurance online, you will need to do the following:

- set all travel parameters;

- put a tick in the box "luggage insurance";

- remove the label "health insurance".

Baggage insurance in one of the air ticket sales agencies

In this case, the choice is small. Separate baggage insurance is rarely sold.

Third way

Many online firms offer to purchase insurance for things when buying a ticket.

If it is part of travel insurance, then you do not need to make this purchase a second time.

It is also not recommended to purchase basic insurance from such companies. They can hardly offer a quality product.

How much

The cost of baggage insurance depends on the carrier. You can insure luggage against loss during the flight for amounts of 500, 1000, 1500 and 2000 euros.

Purchasing separate baggage insurance

The best offer can be obtained from the following insurers:

- Agreement.

- Renaissance.

- Alpha insurance.

- Russian standard.

- Tinkoff.

- Absolute.

- Support.

- Zetta.

- Rosgosstrakh.

- Arsenal.

- Liberty.

The cheapest option for Europe

Baggage insurance for 1 traveler planning a trip to the Schengen countries, with the option "Flight insurance" disabled and the amount of 500 euros, will look like this:

You can learn more about luggage insurance in the video.

From the video you can learn more about travel insurance.