Do I need insurance if I have a Schengen visa?

Situation: This year, when applying for a trip to Spain and the corresponding visa (for a period of 180 days, this is important), Pegasus-tourist issued a honey. insurance only for the duration of the tour, v.1. 10 days. Although at the same time, as far as I know, when applying for a visa to any Schengen country, medical insurance must be for the entire duration of the visa, i.e. "saved". I wonder how they got away with it?

But the question is different: is there a mention in the legislation of the Russian Federation or any Schengen country (personally, I am now interested in Austria and Hungary, but let's take all countries of the agreement) about the NEED to have honey. insurance upon entry into the country (leaving aside the fact that this should not be the case, because insurance should already be at the stage of applying for a visa)? Please do not talk about the need for insurance, because "I always take it" and "how could it be without it." I will also issue it for 7 euros in one company of three letters, but the principle itself is of interest - is it formally needed?

PS: I am interested in an independent trip, and not a second trip on the "balance of a visa" with the help of a tour operator

PPS: maybe Pegasus insurance is still valid for the entire period of the visa? True, the term of insurance in it is 17.06-28.06 and the country is Spain. Although why is the country indicated if, at the request of a visa, the territory of the policy is all Schengen countries? And for some reason, this “policy” does not even have the name of the insurer (I just noticed this now). There are only phones to call in case of "something". Maybe it's not insurance at all, but "linden"? Although Pegasus is like an office from those that should not allow themselves to be substituted like that, because in plain sight.

They did everything right. When applying for a multiple-entry visa, insurance can be issued only for the first trip, while the obligation to issue insurance for each subsequent trip is signed. It is now imprinted in the visa application form, before that it was a separate paper. Those. if you are going to the Schengen area on the same visa again, on your own or through a company, you will need to take out insurance.

Estonians and Norwegians always check insurance when entering the country, Finns - extremely rarely, other Schengen countries - never, although they have the right to do so.

A visa is not a guarantee of access to the Schengen countries. The final decision lies with the immigration officer at the border.

In addition to a valid passport with a visa (except for privileged citizens), every foreigner must be able to provide the following documents to an immigration officer:

Regarding his/her stay in Spain:

For tourism: hotel reservation, documents from a travel agency

For a professional visit: a letter from an employer, an invitation from a Spanish company or organization.

Proof of health insurance that covers all types of expenses, including a doctor, hospital stay and social assistance.

Concerning his/her livelihood:

Economic guarantees: certificate from the place of work indicating the position and salary

Financial condition: 57€ per day of stay per person, proof can be a credit card accompanied by a summary of the bank account (a summary statement obtained via the Internet will not be considered), traveller's checks or a certificate of purchase of foreign currency)

Guarantees to leave the country

Air ticket (round trip)

MAIN DOCUMENTS FOR ISSUING A TOURIST VISA

6 Health insurance policy for all types of assistance, for the entire intended period of stay in the Schengen area. Insurance coverage of at least 30,000 euros.

7 A signed "Health Insurance Commitment" in which the applicant voluntarily agrees to purchase health insurance whenever he reuses an outstanding visa.

Medical insurance for a Schengen visa and to Europe - types, cost

Updated: 2018-07-17 Oleg Lazhechnikov 23

Separately, I analyzed the general topic of health insurance, it's time to add information on insurance to Schengen on the blog, because there are some nuances. Starting with the fact that it must be done, ending with the fact that it is often more profitable to make annual insurance, and not for specific dates, which not everyone knows about.

And such an important point. Insurance can be done in Europe, or for a Schengen visa. It seems to be the same thing, but below I will explain what the difference is.

Schengen visa insurance

Why do you need health insurance

- I highly recommend the Cherehapa service, where you can compare prices for 16 insurance policies in one place, filtering them by options, very convenient. Also, the support is very friendly and will answer any of your questions, I myself constantly turn to them. Well, when buying a policy from them, it will be cheaper than from an insurance company, since they have special conditions.

- If you are new to the insurance business, then be sure to read my main post about insurance. From it you will learn why assistance is so important and what it is, how to choose the right insurance, how to use it and avoid rejection, what options do not make sense to add.

The choice is always yours, if you want to choose something specifically for yourself, you will have to read, compare and analyze.

Medical insurance for a trip to Europe is mandatory, it will not be possible to do without it for three reasons:

Medical insurance for Schengen visa

Sum insured

According to the rules, for a Schengen visa you need insurance covering at least 30 thousand EURO (not dollars). Just in case, I'll write what it is. What is called “coverage”, and it would be more correct to call it “sum insured” is the maximum amount of insurance payments. That is, in which case the insurance company will pay the costs until the total amount of payments reaches this figure. This is in theory, but the reality is a little different.

Insurance for a year and for specific dates

Insurance can be purchased for one trip or several at once. In the first case, insurance is issued for specific dates, for example, for 2 weeks from such and such to such and such a date. In the second case, not only the dates of insurance are indicated, but also the number of days of insurance, for example, insurance for a year from such and such a date and the number of insurance days is 14. Now I will explain what the difference is.

In the first case, you will be insured for exactly 2 weeks and that's it. Moreover, if for some reason you leave earlier and stay, let's say in Europe for only 1 week, then the rest of the insurance will expire. In the second case, you will be able to enter the Schengen several times during the year, and the insurance will end when the total number of days of stay in the Schengen exceeds 14 days. Annual insurance is convenient for those who often travel to Europe, you can buy immediately for a year, indicate, for example, 90 days of insurance, and that's it, you can not think about insurance for a whole year. Naturally, you need to buy for as many days as you travel in total throughout the year. If these are two vacations of 14 days, then it is enough to buy annual insurance with 28 days of stay.

Directly to obtain a Schengen visa, both annual and five-year, it is enough to make insurance for the first trip, it is not necessary to make insurance for a year. Here everyone chooses for himself what is more convenient and better for him. But! Annual can be cheaper, which is why I am writing about it here.

What is it connected with? Those who buy a whole year of insurance rarely use all the days. Those who buy specific dates almost always use them. Here is simple arithmetic, we calculate the probabilities - hence the cost of insurance.

Average insurance cost

In his post about the cheapest insurance in Schengen, he gave specific examples with prices. Check it out, there are interesting options.

Please note that insurance for a long continuous trip usually costs more. Therefore, if it seems to you that there is no limit on the duration of one trip and at the same time the insurance has a small cost (less than 100 euros for 180 days), it makes sense to double-check everything.

In general, before buying insurance, call your bank. It is quite possible that you already have excellent insurance with a bunch of additional bonuses, you just need to activate it and print it out.

Where to buy insurance

I recommend the Turtle service, where you can compare prices for 16 insurance policies at once. The service has existed for a long time and their list has all the necessary insurance. Now there is no need to look at dozens of websites of insurance companies and compare prices, insurance conditions, assistance. Everything is in one place. In addition, they still provide normal support (which cannot be said about insurance companies, where managers who don’t know anything sit) on insured events and can advise on various issues related to the insurance contract, the choice of insurance, etc. It’s funny, but some insurance companies still don’t even buy a policy online ...

And such an important point - they, being intermediaries, play a very positive role, customers of the service find themselves in a more privileged position than other insurance customers. This is a fact, I checked it myself when I got to the entire sum insured. If something is not clear, then I have detailed instructions on how to compare insurance on Turtle.

Insurance not for a trip, but for a visa

I specifically put it in a separate subheading, because it is important. As I wrote at the very beginning, you can make insurance for a trip to Europe, or you can do it purely for a visa. The fact is that our Russian insurance companies work so-so, so some travelers prefer not to take out any insurance at all, but to have a credit card in reserve or cash. The option, in my opinion, is doubtful, but having already had experience in dealing with insurance companies and often reading reviews about them, I can understand this position too, especially if a person has money.

So, if you are going to use travel insurance to the fullest and carefully approach this issue, then this paragraph is not for you. But if you rely more on credit/cash, then read on. Since it is impossible not to have insurance at all when traveling to Europe (they simply won’t give you a visa), you can get the cheapest insurance just for applying for a visa. There are different options, but I would recommend doing it at the Eurotrip agency, it costs mere pennies. But I recommend this insurance, not only because of the price (although you won’t find cheaper anyway), but because it also works! You will receive insurance from Alfa Insurance with Savitar, but if you take it directly from Alfa, then there will be a completely different price and very poor GVA assistance.

What is an assistant?

If you need to not only buy insurance for a visa, but you also intend to receive medical assistance, then you need to understand this issue a little. This is especially true for those who are going to do extreme sports in Europe, for example, skiing (you need the Active Leisure package). Since I am not extreme, I usually apply for insurance when a child has a high temperature (experience in applying for insurance in Poland).

The insurance company that sells the policy to you and the company with which you will communicate by phone in the event of an accident are two different organizations. Each insurance company works with one or more assistance companies. When you buy a policy, it will indicate the assistance company that will support your policy. Be sure to pay attention to what kind of assistance is indicated in your policy - it often happens that the information on the site differs from reality, and the operators from the call center do not rummage about this issue at all. It is advisable to find out the assistance in advance.

It is the assistant you will call if something happens. It will depend on the assistant and his agreements with hospitals which hospital you will be sent to and how the treatment will be paid. In the end, it depends on the assistance how polite and adequate the operator will be and in what language the support will be conducted. If bad reviews about the work of the insurance company are associated with such problems, then look who was the assistant and look for an insurance company working with another assistant.

But problems with payment, refusal to pay for transport, the speed of coordinating any monetary issues - these are the jambs of the insurance itself, and you can choose another insurance company with the same assistance.

And most importantly - remember that the insurance policy works according to certain rules. Most of the negative reviews and claims against insurance companies are based on ignorance and non-compliance with the rules of this insurance. Read carefully the rules written on your policy (not on the website - namely on the copy sent to you by email, they may differ). And if something happens - first of all, call the assistance. The insurance company may refuse to pay for any medical expenses that are not agreed with them.

P.S. Read more about the nuances of choosing an insurance company, about the rating of assistants, about the procedure for using insurance, read in my post - travel insurance.

Life hack 1 - how I save on hotels

It is necessary to search not only on Booking.com! I use the RoomGuru website for this (there are also mobile applications for Android and iOS). This service searches for discounts on 30 booking sites at once, including Booking too.

Life hack 2 - how I save on insurance

Choosing insurance is now unrealistically difficult. I need one that's affordable and works. I constantly monitor forums, read insurance contracts, and use insurance myself. Then, to help all travelers, I make my rating.

How and where to get insurance for a Schengen visa? Rest without risks

Medical insurance is included in the list of mandatory documents that should be prepared for obtaining a Schengen visa. The demand is quite justified: the services of doctors in Europe are expensive, and a foreigner in an emergency may not have the money to cover the necessary expenses. Health and even life in this case are at risk.

An insurance policy issued before traveling abroad saves a foreign guest from a number of unforeseen expenses for their own health. If a citizen decides to choose an extended insurance program, depending on the terms of the insurance contract, he has the right to hope for compensation not only for treatment, but also for a number of other expenses - for travel of relatives to the hospital, legal assistance and even organization of a rescue operation. Let us consider in more detail the rules for issuing a policy, the cost, and also where you can get insurance for a Schengen visa.

Requirements for medical insurance for a visa to the Schengen countries

Medical insurance for those traveling abroad is necessary in case a foreign citizen needs medical assistance during an unscheduled trip. The reason may be an injury, illness or a sharp deterioration in well-being. If the reason for which the health has suffered falls under the category of an insured event, the insurance company, depending on the conditions of insurance, will cover the costs of providing medical care. The task of the policy holder in this situation is to promptly inform the insured about the incident. Then they will tell him which clinic to contact, answer questions, and, if necessary, provide an interpreter (if it is provided for by the insurance program).

To visit the Schengen countries, health insurance is a prerequisite - if you do not have it, you will be denied a visa. Moreover, each applicant, including children, must issue an insurance policy. The only exceptions are spouses of EU citizens and their children.

The key requirements for the policy are as follows:

Despite the unity of the Schengen area, each country puts forward its own requirements for documents, including travel insurance for a visa. In order not to be mistaken, you should carefully study the information on the official website of the embassy, consulate or visa center of the country whose visa is planned to be requested.

How to get an insurance policy

Insurance for a Schengen visa can be obtained in two ways: online on the website of the insurance company (or intermediary) or during a personal visit to the office. In the second case, you must present a Russian and foreign passport and answer a few questions regarding the trip:

Then it remains to choose a tariff and pay the insurance fee. The policy will be issued within a few minutes. Another option is to do it without leaving your home. The client will be offered to fill out a questionnaire, indicate the data of the passport and pay a fee from a bank card or virtual wallet. The company will send the finished policy in electronic form (usually in PDF format) by e-mail immediately after payment. It will need to be printed and attached to the package of documents for the consulate. The electronic version of the policy has the same validity as that printed on official letterhead.

Thus, the algorithm of actions and the list of documents when buying a policy remotely or in person are the same. However, most travelers prefer to take out medical insurance for a Schengen visa online. No need to waste time driving to the office and waiting in line. The client has the opportunity to pre-calculate the cost of the policy using a virtual calculator. From time to time, insurers arrange promotions and issue promotional codes that allow you to buy insurance at a reduced price.

The cost of insurance for a Schengen visa

The cost of medical insurance for a Schengen visa depends on a combination of factors, namely:

- selected insurance program: economy option, standard or extended premium package;

- the duration of the policy;

- coverage amount - the maximum amount of payment in the event of an insured event;

- the age of the insured and the state of health.

- transportation to a medical facility;

- stay and treatment in a hospital or on an outpatient basis;

- necessary medical advice;

- surgical operations;

- purchase of medicines prescribed by a doctor;

- emergency dental care, excluding planned treatment (tooth trauma or acute inflammatory process);

- repatriation of remains.

- trip cancellation insurance;

- compensation for losses in case of flight delay;

- reimbursement of expenses in case of an accident;

- civil liability insurance.

- Inheritance / Sample documents Appendix to the Order of the Ministry of Justice of the Russian Federation "On approval of the Register Forms for registration of notarial acts, notarial certificates and authentication inscriptions on transactions and certified documents" dated 10 […]

- State benefits to families raising children Normative document on the assignment of state benefits to families raising children: Amount of state benefits to families, Average subsistence budget per capita: from 01.11.2012 to 01.31.2013 - 880,030 […]

- A social disability pension is paid to a child under 18 years of age, if 3 conditions are met simultaneously: The child’s parents, guardians and any other legal representatives in whose […]

- Stay 90 days The period of stay of foreign citizens in Russia should not exceed 90 days every six months, ie 180 days. This rule applies to visa foreigners who came on a business multiple entry visa valid from 1 to 5 years, as well as visa-free foreigners from […]

- Heading: Preparation for the Unified State Examination in the Russian language To prepare for the Unified State Examination in the Russian language, a lot of materials have been collected here, including both theory and practice. To get a certificate, you need to pass two mandatory exams in the form of the Unified State Examination - Russian language and mathematics. […]

When applying for a Schengen visa, the amount of coverage must be at least 30 thousand euros. This is an economical package that includes the cost of treating a foreign citizen who is injured or suddenly ill. Here are some examples of expenses that an insured client of a number of insurance companies is entitled to receive indemnification at an economical rate:

Following the economy tariff is the standard one, which may additionally include a few more points. For example, payment for travel to the place of residence after the hospital, accommodation until departure after inpatient treatment, etc. Travelers seeking to protect themselves from possible expenses as much as possible can apply for a premium class program, which, among other things, may include legal and administrative assistance, payment for travel by ground transport, if the flight after treatment is contraindicated, the return to their homeland of children who were together with victims, etc.

When applying for insurance for a Schengen visa, the client can include items that are not related to medicine. For example, insure luggage against loss, air travel - against flight delays, yourself - against loss of documents, etc. Obviously, with the growth of the list of services, the price of insurance for a visa also increases. For comparison, an insurance policy for the minimum required 30 thousand euros for 10 days of stay in the Schengen area for one person will cost approximately 500 to 800 rubles, depending on the chosen company. If you expand the amount of coverage to 100 thousand euros, the lower limit of the cost will increase to about 740 rubles, the upper one to about 1.8 thousand rubles. And if you additionally insure luggage, the price range will take the form of about 1 thousand-2.5 thousand rubles per person.

The question often arises: how to buy the best insurance for a visa so as not to overpay, but also not to be left without support in case of force majeure? Experienced insurers advise assessing risks objectively. If you are waiting for a relaxing holiday on the territory of the hotel, you can get by with the minimum required amount. If your plans include conquering a wave on a surfboard or deep diving, it is better to enable the option that adds active sports to insurance cases. Expensive things in luggage make sense to provide financial protection, while a simple bag of clothes can go on a flight without an insurance policy. The most important thing is the understanding that insurance is not just a formality for obtaining a visa, but a real opportunity to save yourself from big problems and overwhelming costs.

Where to get insurance for a Schengen visa

There are a large number of insurance companies on the market where you can get insurance for a Schengen visa. They differ not only in the tariffs for their services, but also in the degree of responsibility towards the client when he finds himself in a difficult situation. What indicators make it possible to judge the reliability of an insurer? First of all, you should pay attention to the official information about the company with which you plan to conclude an agreement. Federal Law No. 4015-I of November 27, 1992 “On the Organization of Insurance Business in the Russian Federation” and the Federal Law of July 23, 2013 No. 234-FZ supplementing it determine the information that the insurer must keep in the public domain on the official website. These are registration data, an indication of a license, annual financial statements for the last three years, confirmed by the results of the audit, as well as ratings assigned by independent agencies.

For example, VTB Insurance has been holding high positions in independent ratings over the past years. (level A++(an exceptionally high level of reliability), according to Expert RA, and BB++, according to Standard & Poor's (the highest reliability rating among insurance companies with Russian capital) - approx. ed.). As for medical insurance for a visa, for example, the VTB Insurance policy is recognized by all consulates of the Schengen countries. In the event of an insured event, it is enough to call once by the phone number indicated in the VTB Insurance policy, and you can be sure that you will receive the necessary medical and other assistance. Calls are accepted only by Russian-speaking operators. In a number of countries (Austria, France, Germany, etc.) we have free telephone lines.

P.S. VTB Insurance has been present on the insurance market since 2000, offering a wide range of insurance services. Branches and sales offices operate in more than 90 cities of Russia. More detailed information about insurance programs and the procedure for providing services is available on the official website of VTB Insurance.

The service is provided by IC VTB Insurance LLC, licenses SL No. 3398 dated September 17, 2015, SI No. 3398 dated September 17, 2015, OS No. 3398 - 03 dated September 17, 2015, OS No. 3398 - 04 dated September 17, 2015, OS No. 3398 - 05 dated 17.09.2015 For citizens of the Russian Federation, more detailed information about the service, the procedure for its provision www.vtbins.ru.

Insurance is not just a formality for obtaining a Schengen visa, but an opportunity to protect yourself and your loved ones from unforeseen expenses.

When traveling abroad, one should approach insurance issues in a timely and responsible manner, especially when it comes to holidays with children or extreme tourism.

The level of reliability of an insurance company is one of the most important criteria when choosing a policy.

Buying a policy will cost a small amount, but this step can fully or partially offset the cost of medical treatment while traveling.

Trip cancellation insurance - the ability to compensate for losses if a pre-paid trip was canceled or rescheduled at the initiative of the tour operator or airline.

Today, you can apply for an insurance policy without leaving your home - online.

The policy with advanced options is:

The service of most insurers today has reached such a level that there is not the slightest need to personally go to the office. Answers to absolutely any questions regarding insurance can be obtained by phone or online. The only thing you should approach with full responsibility before contacting an insurer is to check the reliability of the insurance company and its financial stability, which are determined, among other things, by independent rating agencies.

asian diary

Southeast Asia for taste, color and wallet

THAILAND. Our guide.

TO VIETNAM

on one's own

TO MONTENEGRO

on one's own

USEFUL POSTS:

DISCOUNTS FOR TRAVEL INSURANCE FOR OUR BLOG READERS

Is insurance required to travel abroad?

This post appeared because I was tired of reading stupidity and outright lies on many websites about compulsory insurance for Russians traveling abroad. Quite a few resources offering travel health insurance services distort information and shamelessly deceive their potential customers.

This post appeared because I was tired of reading stupidity and outright lies on many websites about compulsory insurance for Russians traveling abroad. Quite a few resources offering travel health insurance services distort information and shamelessly deceive their potential customers.

Below I will talk about when traveling to which countries medical insurance is mandatory, and which are not. I’ll also write a few words about the new law, supposedly obliging all Russians to buy insurance when leaving the Russian Federation, and about the difference between the terms “needed” and “mandatory”.

"Compulsory" travel insurance

In late December 2015 - early January 2016, Russian media, including Rossiyskaya Gazeta, announced that Russian tourists, when traveling abroad, must now without fail take out medical insurance for at least 2 million rubles. The reason for such statements was the amendments to the federal law "On the Fundamentals of Tourist Activities in the Russian Federation" that came into force, allegedly establishing the requirements for compulsory insurance.

It's a lie.

It is worth reading these amendments carefully, as it becomes clear: there is no question of any mandatory insurance; Basically, the activities of tour operators in the field of tourist insurance are streamlined there. Moreover, it is explicitly said that even “bags” can refuse insurance.

The tour operator (travel agent) is obliged to explain to the tourist against a personal signature that in case of refusal to conclude a voluntary insurance contract, the costs of providing medical care in emergency and emergency forms in the country of temporary residence are borne by the tourist himself, and the costs of returning the body (remains) are borne by persons interested in the return of the body (remains).

As for independent travelers, they are all the more not obliged to buy insurance when leaving Russia.

Inaccurate information spread by the media was happily picked up, replicated by some Internet resources that offer travel insurance services and do not disdain to deceive customers for profit.

Let's summarize again: Mandatory travel insurance is a lie!

If everything is clear with insurance for leaving Russia, you released without insurance, then with insurance for entering other countries - in different ways, not allowed everywhere without a policy.

When visiting which countries is health insurance required?

The obligation to issue a medical policy is contained in the requirements for obtaining a visa to the Schengen countries. That is, you need insurance to Spain, insurance to Italy, Germany, Poland, Latvia and others.

The obligation to issue a medical policy is contained in the requirements for obtaining a visa to the Schengen countries. That is, you need insurance to Spain, insurance to Italy, Germany, Poland, Latvia and others.

To visit the Schengen, insurance is not only obligatory, but also must meet a number of conditions. You can read more in our post: Schengen visa insurance.

In addition, there are several countries that already have one foot in the Schengen, so they adjust their visa rules to the Schengen standards. When obtaining a visa, insurance will be required for Bulgaria, Croatia and Romania. A medical policy for these countries is issued in the amount of 30,000 euros for the entire duration of the trip.

Travel insurance to other European countries is not required. I have not found a single country at all, except for the Schengen states and those who are preparing to enter there, where the policy is required without fail. If you know of such, please write in the comments.

When applying for a visa to Australia insurance is compulsory for citizens over 75 years old, for the rest “recommended”, but not included in the list of required documents.

Information - on the website of the Australian Embassy.

Which countries do not require travel insurance?

I repeat once again that I am not aware of any country, except for the states of the Schengen Agreement, upon entry into which insurance would be required without fail.

I repeat once again that I am not aware of any country, except for the states of the Schengen Agreement, upon entry into which insurance would be required without fail.

In the same Europe, insurance is not required for Montenegro and the UK, which are not included in Schengen. Despite the visa entry, no insurance is required for Cyprus.

USA travel insurance is optional. Do not believe the lies on some sites that claim otherwise - better check the information on the official site.

Insurance for a trip to Israel with a visa-free entry for up to 90 days is not mandatory, but the embassy of this country recommends having it (it is also recommended to have a proof of accommodation reservation and return flights).

No insurance required for Georgia. To travel to this country you only need a passport.

No travel insurance required for Turkey. In addition to a passport, nothing is required at the Turkish border.

Insurance to China is not required - both for visa-free travel and for obtaining a Chinese visa.

When visiting Singapore - similarly, not required. In some places it is stated that insurance is “highly desirable”. This is a fiction of agencies involved in issuing visas to Singapore and simultaneously selling insurance.

You can check the information on the website of the Singapore Embassy in Moscow.

Of course, it is not obligatory to take out insurance to visit such countries popular with Russian tourists as Thailand, Vietnam or Turkey.

Do I need insurance when traveling abroad?

Now a few words about the difference in the concepts of "obligatory" and "necessary".

Now a few words about the difference in the concepts of "obligatory" and "necessary".

"Required"- this is when the availability of insurance is a mandatory requirement when obtaining a visa or crossing the border of a state.

"Need"- this is a subjective opinion about the need, expediency to insure when traveling to another country.

And if insurance is mandatory for Schengen countries, then for trips to all other countries, in my opinion, it is needed. Someone may have a different opinion about this and not be insured.

We are always insured. The fact is that medical services abroad are very expensive, and we, as a rule, do not have a few extra thousand dollars “just in case”. Yes, and $ 100-200 for a visit to the doctor does not hurt to spread out of your pocket. Rare, alas, the trip is complete without going to the clinic. Even if we apply for little things like the flu virus or food poisoning, the cost of clinic services that the insurance company pays for always exceeds the cost of the policy. For example, when we bought insurance for a trip to Thailand, we paid 5 558 RUB. for two, and the bill for one visit to the clinic for SARS was 5,911 baht, - more than 2 times more than the cost of the policy. That is, to be insured profitable.

You can read more about where, in our opinion, it is better to insure when traveling abroad.

Perhaps you are surprised that at first I was so emotionally told that you do not need insurance when traveling to most countries of the world, but at the same time I always insure myself. Everything is simple. We believe that insurance is necessary and profitable. This is our opinion, confirmed by personal experience. This is a conscious choice. Other travelers have different opinions and different experiences. This is also their conscious choice.

A person should have the right to choose. The right decision is based on reliable, necessary and sufficient information. Lies, the number of which is already off scale, this, to put it mildly, does not contribute.

Travel insurance discounts

If you think that you need travel insurance, or it is necessary for obtaining a visa, you have the opportunity to buy policies from several insurance companies with 5% discount .

Discounts for readers of our blog provide:

- Tripinsurance- one of the best insurance, about which almost all traveler reviews are positive.

- Polis812- an aggregator that compares the policies of a dozen insurers.

In my opinion, of the options available on Polis812, the most reliable are Allianz And ERGO with assistance AXA Assistance.

- Instore.travel- the aggregator gives discounts for any Allianz insurance and ERV annual policy.

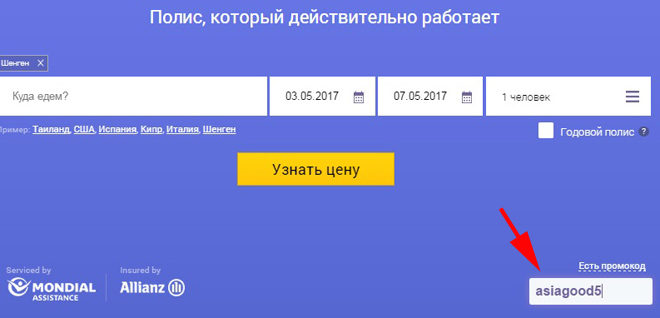

How do I get a discount on my Tripinsurance policy?

1. You need to go to the Tripinsurance website by this link;

2. In the lower right corner, click on the inscription "There is a promotional code";

3. In the window that opens, enter the code word asiagood5.

The act of refusal to sign in the order of disciplinary action Refusal to sign the order of the employee was punished with a fine. the worker refuses to sign the punishment order. what should a staff member do? Lawyers' answers (4) Hello, Natalia! If the employee refuses to sign the punishment order, then an act of refusal is written. WITH […]