Saudi Arabia will create the world's largest investment fund for $2 trillion. Saudi Arabia Sovereign Wealth Fund Russian Saudi Investment Fund

Moscow. July 7th website - The Russian Direct Investment Fund and Saudi Arabia's Public Investment Fund (PIF) are establishing a partnership under which PIF will invest $10 billion primarily in projects in Russia, RDIF said.

This is the largest commitment by a foreign investor in the history of the RDIF (the previous "record" was set by an agreement with the UAE sovereign wealth fund - for $7 billion), and one of the largest partnerships of its kind in the world, RDIF head Kirill Dmitriev told Interfax.

The priority sectors for partnership will be infrastructure, agriculture, medicine, logistics, retail, and real estate.

RDIF plans about ten projects, with potential investments of $1 billion each. The fund is going to carefully analyze possible objects for investments. Dmitriev specified that $10 billion would be invested not in a month, but in 4-5 years.

According to him, seven projects have already received preliminary approval, in total, about ten transactions may take place within the framework of partnership with PIF by the end of the year. At the same time, various mechanisms will be used that have already been tested within the framework of the Russian-Chinese investment fund and other joint RDIF platforms, including the automatic co-investment mechanism. RDIF has not yet commented on the question of whether public companies will be among the objects of investment in partnership with PIF.

Within the framework of partnership with PIF, the possibility of investments in third countries is not ruled out.

RDIF also entered into a partnership with another Saudi Arabian sovereign wealth fund, the Saudi Arabian General Investment Authority (SAGIA). The parties will conduct a joint search for investment projects on the territory of the Russian Federation. SAGIA is also responsible for attracting investments to Saudi Arabia, the fund's cooperation with RDIF will help Russian companies enter the market of the Arab state, Dmitriev said.

The successor to the Crown Prince of Saudi Arabia, Muhammad bin Salman, in June in St. Petersburg, and also participated in the meeting of the President of the Russian Federation with members of the international expert council of the RDIF as part of the SPIEF on June 18. "Undoubtedly, the meeting with the President greatly contributed to the decision to create a partnership," said K. Dmitriev.

RDIF already has a number of partnerships with sovereign wealth funds of Arab oil exporting countries (UAE, Kuwait, Qatar, Bahrain).

“Bilateral cooperation between Russia and Saudi Arabia in the trade and economic sphere has reached an unprecedented high level. In recent years, a comprehensive breakthrough has been made in relations,” said Alexander Novak, Minister of Energy of the Russian Federation and co-chairman of the Russian-Saudi Intergovernmental Commission on Trade, Economic, Scientific and Technical Cooperation, on the sidelines of the Russian-Saudi Investment Forum in Riyadh. The forum, organized by the Russian Direct Investment Fund (RDIF) and the state investment agency of Saudi Arabia Sagia, is timed to coincide with the state visit of Russian President Vladimir Putin to the kingdom.

On Monday in Riyadh, in the presence of Russian President Vladimir Putin and King Salman ibn Abdulaziz, Russia and Saudi Arabia signed 21 documents concerning the development of bilateral relations. About 20 more documents were signed before Mr. Putin's plane landed in Riyadh. Meeting the President of Russia in his palace, King Salman highly appreciated the prepared bilateral documents, noting the investment cooperation between the two countries. “We welcome the investment of RDIF and PIF (Saudi sovereign wealth fund.- "b") in more than 30 projects and emphasize the important role of the first meeting of the Russian-Saudi Committee, which will take place during your visit,” he said.

OPEC +: the main thing is balance

A special place in Russian-Saudi relations is occupied by partnership under the OPEC+ deal. For President Putin's visit to Riyadh, a charter of long-term cooperation between the OPEC countries and countries outside the cartel was prepared. The document was initialed at a ministerial meeting in Vienna this summer, but the solemn signing was postponed until Vladimir Putin's meeting with King Salman. “This is not only about interaction in terms of adjustments in order to balance the market, this is a much broader interaction based primarily on the development of our joint cooperation in this area and the bilateral and multilateral format,” said Alexander Novak. He explained that in this agreement any country will not have a leading role. The Russian minister also assured that the countries participating in the OPEC + deal are not discussing the revision of the terms of the agreement.

Recall that on the eve of his visit to Riyadh, Vladimir Putin said in an interview with Arabic television channels that oil reserves should be reduced to a reasonable limit so that they do not put pressure on its prices.

“I think that the president was referring to the successful experience that OPEC + has in balancing the market and taking certain actions in this regard, if necessary,” Alexander Novak explained to reporters.

The words of the Russian president were commented to journalists by Saudi Energy Minister Prince Abdulaziz bin Salman. “I really, really liked the words of President Putin. He understands that we must take any action to prevent disasters in this market. Inventories are usually high in the first quarter. I think we need to do more work to make sure stocks are back to normal. But I would not like to anticipate the decision of our meeting (OPEC+.- "b") in December,” he said.

Strategic vision

Prince Abdulaziz has just been appointed as the kingdom's energy minister. At the same time, he got the post of co-chairman of the Russian-Saudi intergovernmental commission on trade, economic, scientific and technical cooperation. In this capacity, he emphasized that contacts are developing not only at the state level, but also at the level of private business. Answering journalists' questions, he did not rule out that in the future it will be not only about Saudi investments in Russia and the work of Russian companies in the kingdom, but also about joint investments of the two countries in projects "not only in the region, but throughout the world" . He highlighted the role of the sovereign wealth funds of the two countries - the Saudi PIF and the Russian RDIF. “They will make a lot of investments, implement many joint projects. But I think the main thing that we saw today is that investments will come from different directions. And this is good,” the minister stressed.

For his part, speaking about the documents signed during the visit, Alexander Novak, in addition to the charter, highlighted:

- program of the Russian-Saudi strategic cooperation of the high level of the joint IGC(according to the minister, it is based on the national development priorities of Russia until 2024 and the Saudi Vision-2030 development concept for the kingdom);

- protocol between the ministries of energy of the two countries(the “road map” of energy cooperation includes 24 initiatives in the oil and gas sector, nuclear energy and other related areas, Alexander Novak noted);

- agreement between governments on the mutual establishment of trade missions(as the minister emphasized, last year the trade turnover between the countries grew by 15% and for the first time in several years exceeded $1 billion, in the eight months of this year the trade turnover has grown by 38% - but at the same time, the minister believes that the potential for trade cooperation is much greater ).

For its part, RDIF paid special attention to the agreement signed in the presence of the President and the King on the entry of a consortium of Saudi Aramco, PIF and RDIF into the equity capital of Novomet, an oil production equipment manufacturer. This is the first joint investment by RDIF and Saudi Aramco as part of the energy platform created in 2017 with the participation of PIF, aimed at investing in companies in the Russian energy sector with the possibility of subsequent business localization.

A cooperation agreement was also signed at the palace between the largest petrochemical company SABIC, RDIF and ESN on the construction and operation of a methanol production plant with a capacity of up to 2 million tons per year in the Amur Region in Russia.

Prior to this, at the site of the investment forum, Saudi Aramco signed about a dozen memorandums of understanding with Russian companies. Among them are Gazprom Neft, Pipe Metallurgical Company, Galen Company, Chelyabinsk Pipe Rolling Plant, Angara Service, Intratool group of companies, Technovec and Integra companies.

- RDIF, Russian Railways and Saudi Railway Company(SAR) agreed to explore the possibilities of cooperation in the field of transport infrastructure construction. The agreement aims to jointly expand the SAR rail network.

- RDIF and Saudi Technological Development and Investment Company(TAQNIA) agreed to cooperate in developing the commercial use of the Russian-made rocket and space complex Start-1. In addition, the agreement provides for the implementation of joint research and production activities for the design and production of additional components of the launch vehicle, which should improve its quality characteristics and commercial demand.

- RDIF, the Moscow Institute of Physics and Technology (MIPT) and the National Center for Big Data and Artificial Intelligence at the King Abdulaziz Center for Science and Technology in the Kingdom of Saudi Arabia have agreed to jointly develop the high-tech field of artificial intelligence.

During the investment forum, RDIF head Kirill Dmitriev also mentioned the plans of Russian companies to build factories in Saudi Arabia, in particular for the production of insulin and other medicines.

Other businessmen also spoke about their projects. Thus, the main owner of AFK Sistema and chairman of the Russian-Arab Business Council Vladimir Yevtushenkov mentioned plans for cooperation with the kingdom in the agro-industrial sector, in the field of high technologies and infrastructure.

“We believe that the investment climate in Saudi Arabia today has changed significantly and has become more comfortable for any foreign investors, including those from Russia,” he stressed, speaking at the forum.

The transaction will be completed after receiving the approval of the Federal Antimonopoly Service (FAS), the RDIF said in a statement. The consortium with the participation of RDIF and Saudi Aramco and PIF made the first application for the purchase of a stake in Novomet, an appeal for clarification, back in February 2019, and the second (on approval of the transaction) at the end of September. “The applicant was asked for additional information. The petition is under consideration, ”a representative of the FAS told RBC. It is expected that the transaction will be completed before the end of the year, one of the interlocutors of RBC said.

The sale of a stake in Novomet to Saudi Aramco is a trial balloon for the admission of investors from Saudi Arabia to the Russian market, said Maxim Khudalov, senior director of ACRA. “Relations between the countries are improving, and perhaps we will still see Arab money in Russian projects,” he believes. Earlier, Saudi Aramco bought a stake in NOVATEK's second liquefied natural gas (LNG) project Arctic LNG-2, intending to invest up to $5 billion in it, but the parties did not agree. An additional condition for the deal with Novomet shares may be the admission of this Russian company to the Saudi Arabian market, the expert thinks.

Agreements for $2 billion

During the Russian-Saudi forum, 30 agreements worth about $2 billion are to be signed, RDIF head Kirill Dmitriev. The largest of them, in addition to buying a stake in Novomet:

- RDIF, the Saudi sovereign wealth fund PIF and the German financial group KGAL on the creation of a new leasing company Roal, which will supply aircraft to Russian airlines under long-term lease agreements. Investments will exceed $600 million.

- RDIF and PIF will also invest $300 million in NefteTransService (NTS), one of Russia's largest railway operators. The investment will help expand the company's rolling stock and strengthen its competitiveness in the rail sector, the Russian fund said in a statement.

- The world's largest petrochemical company Sabic, based in Saudi Arabia, together with RDIF, will invest in a methanol production plant with a capacity of up to 2 million tons per year of Grigory Berezkin's ESN group in the Amur Region. Sabic's investment was not disclosed, but was previously estimated at $700 million.

Pumps for Saudi Arabia and the Middle East

Novomet, with two industrial sites and headquarters in Perm, manufactures oil submersible equipment and provides drilling services to oil companies in Russia and abroad. According to RDIF, the company ranks sixth in the world among oil production solution providers (3.9% of the global oilfield service equipment market).

Rusnano, together with the Baring Vostok and Russia Partners funds, invested in Novomet in 2011. During this time, the state-owned company invested 3.92 billion rubles. directly to the project, and the funds bought the shares of the founders, the representative of Rosnano notes. Now the six founders have 49.9% of the company left, while Baring Vostok and Russia Partners have less than 20%. “Over the past nine years, with the participation of Rosnano, Novomet has become one of the leaders in the Russian oilfield equipment market and entered the top 10 of the world market. Rosnano's investments allowed the company to modernize the production of submersible pumps for oil production in Perm, increase revenue by 3.5 times, to 23.2 billion rubles, expand the international equipment supply network to 25 countries and open 12 equipment service centers around the world. , - Anatoly Chubais, Chairman of the Management Board of Rosnano Management Company, reported (his words are given in the message).

Chubais expects that the arrival of a strategic investor in Novomet, represented by one of the world's largest oil companies Saudi Aramco, will strengthen the high status of the Russian company in the international oilfield services market and give a new impetus to its development. RDIF, in partnership with Saudi Aramco and PIF, intends to significantly expand Novomet's business in Saudi Arabia and other key markets in the Middle East, Dmitriev confirmed. According to him, Novomet will be able to expand the portfolio of orders for the production and maintenance of equipment, and will also have the opportunity for further development and creation of an updated product line.”

This is not the first attempt to attract a strategic investor to Novomet. Previously, 100% of the company was going to be bought by the American state-owned oilfield service company Halliburton, but in early 2018 it withdrew its application from the FAS. Then the head of the service, Igor Artemyev, suggested that Halliburton was waiting for the next sanctions against Russia and the Americans “just feel in this situation that they themselves don’t need anything.” “Compared to the deal with Halliburton, which acted as a strategic investor with a premium for 100% of Novomet, the consortium involving Saudi Aramco and RDIF acts more like a financial investor,” a source close to one of the parties to the deal told RBC. Nevertheless, even having agreed to sell to this consortium, Rosnano could earn more than 3.5 billion rubles from this investment.

“Baring Vostok does not plan to participate in the deal with Saudi Aramco and RDIF, but is considering the possibility of selling its stake in the company and is negotiating with potential buyers,” a representative of the investment fund told RBC.

Novomet has grown well in recent years and had access to international markets (40% of its revenue is exported), so Saudi Aramco's interest in the company is understandable, Khudalov notes. According to him, taking into account the growth of the portfolio of orders, the return on investment for new shareholders can be up to three years. About half of Novomet's revenue is received abroad, mainly from North and South America, Danila Shaposhnikov, partner at the TerraVC investment company, confirms. Entering a new region (the Middle East) logically fits into Novomet's development strategy: the company is actively diversifying its business and launching new high-tech oilfield services and services.

The Russian Direct Investment Fund (RDIF) and the Public Investment Fund (PIF) from Saudi Arabia announce the creation of a Russian-Saudi platform for investment in the technology sector. This is stated in the message of the fund.

The new structure will focus on finding attractive investment opportunities in the Russian high-tech sector, including e-commerce, digital infrastructure, big data and others.

The volume of the Russian-Saudi platform for investments in the technology sector will be $1 billion.

RDIF and PIF are also looking at a number of attractive investment opportunities in sectors such as retail, construction, alternative energy, transport and logistics infrastructure.

Kirill Dmitriev, CEO of the Russian Direct Investment Fund (RDIF), said: “We and our Saudi partners believe in the potential of Russian high-tech companies and consider this sector to be key for the further development of the economies of both countries. That is why we decided to highlight the search for attractive opportunities in the technology sector in a separate area of work for RDIF and PIF. The created platform will allow us to make the most of the investment potential and expertise of our teams to create and implement advanced technological solutions not only in Russia and Saudi Arabia, but also in the global market."

The Russian Direct Investment Fund (RDIF) is a sovereign investment fund of the Russian Federation, founded in June 2011 with the aim of making equity investments primarily in Russia, together with leading foreign financial and strategic investors. The fund acts as a catalyst for direct investment in the Russian economy. The Management Company of the Fund is located in Moscow.

The Russian-Saudi Investment Fund was established by the Russian Direct Investment Fund (RDIF) and the Public Investment Fund (PIF) to invest in attractive projects, primarily in Russia, that contribute to strengthening trade, economic and investment cooperation between the Russian Federation and the Saudi Arabia. Among the priority sectors for investment: food production and agriculture, the consumer sector and the service sector, healthcare and pharmaceuticals, innovation and high technology, and infrastructure.

Public Investment Fund - In March 2015, the Council of Ministers issued a decree transferring oversight of PIFs to the Council for Economic and Development Affairs (CEDA). As part of this process, a new PIF Board of Directors has been appointed, chaired by HRH Crown Prince Mohammad bin Salman Al Saud.

In order to help achieve the objectives of the Saudi Vision 2030 program, the PIF Board of Directors has adapted the Fund's strategy in accordance with the program.

PIF develops a portfolio of high quality domestic and international assets diversified across sectors, geographies and classes. Together with global strategic partners and renowned investment managers, PIF acts as the Kingdom's main investment arm to implement a strategy aimed at generating attractive returns for the Kingdom of Saudi Arabia in the long term.

Saudi Arabia is the world's largest oil exporter. This creates the prerequisites for the creation of a sovereign wealth fund in this country. However, for a long time, Saudi Arabia hesitated to use the sovereign wealth fund as an active participant in global financial markets. The geographic location, economic condition and size of the country's population require a significant degree of financial liquidity and a low degree of risk. For this reason, the investment policy of this country differs significantly from other countries in the Persian Gulf. Only in April 2008 did Saudi Arabia announce the creation of a sovereign wealth fund. Until that time, its overseas assets were managed by the Saudi Arabian Monetary Agency (SAMA), the Central Bank of the Kingdom of Saudi Arabia.

In 2008, the agency's non-reserve foreign assets exceeded $300 billion. The reserves amounted to about 30 billion dollars. In addition to these funds, the Saudi Arabian Monetary Authority (SAMA) managed approximately $60 billion in assets, including Saudi Arabian pension funds, on behalf of and on behalf of other agencies. These assets were invested primarily in liquid, low-risk bonds, but also included equities and high-risk bonds, making the agency a conservative investor. McKinsey estimates the fund's investments in cash and deposits at the level of 20%, investments in financial instruments with fixed income at the level of 55-60%, investments in shares at the level of 20-25%, the share of investments in US dollars - up to 85%. At the same time, other data are also available, according to which the share of the fund's investments in US dollars is about 75%, and about 25% in other currencies (see Table 64).

Table 64

Investment structure of the Saudi Arabian Fund

Source: .

According to the Institute of Sovereign Wealth Funds (SWF), Saudi Arabia's SAMA Foreign Holdings is the world's third-largest fund behind the UAE and Norway. Its assets are about 439 billion dollars. The main source of income is proceeds from oil exports. About 65% of the fund's investments are investments in fixed income financial instruments, about 25% - investments in shares, about 10% - investments in deposits.

According to the Institute of Sovereign Wealth Funds (SWF), this fund has a low Lenabourg-Madwell Transparency Index of 2 in autumn. Saudi Arabia's SAMA Foreign Holdings Fund is a fund in the Central Bank of the country. The Saudi Arabian Monetary Agency (SAMA), the central bank of the Kingdom of Saudi Arabia, was established on November 4, 1952. The Central Bank of Saudi Arabia is the second oldest bank among the Arab countries. It manages the Saudi Arabia SAMA Foreign Holdings fund. The Saudi Arabian Monetary Agency (SAMA) acts as the Central Bank of Saudi Arabia and manages the government's assets and accounts. The main functions of the Saudi Arabia Monetary Agency (SAMA) are:

- managing the issuance of the national currency, the Saudi rial; functioning as a government banker;

- management of commercial banks;

- management of the country's foreign exchange reserves;

- conducting monetary policy;

- measures to ensure the growth and stability of the financial system.

The management structure of the Saudi Arabian Monetary Agency (SAMA) includes a board of directors, a manager, a vice-manager, a legal department, a banking institution, a general investment department, a technical and administrative department (see Table 65) .

As of June 30, 2010, the balance sheet currency of the Saudi Arabian Monetary Agency (SAMA) amounted to 589.094 million rials (as of January 14, 2011, 1 Saudi rial was equal to 8.007 Russian rubles), (see Table 127). In the structure of assets, investments in securities abroad accounted for the largest share (1144.319 million rials). In the structure of liabilities, state deposits accounted for the largest share (860.301 million rials). In the first quarter of 2010 there was an increase in government deposits and government agencies and institutions by 2.6%.

Table 65

Management structure of the Saudi Arabian Monetary Agency (SAMA)

Source: .

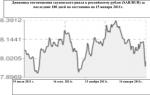

As shown by the dynamics of the exchange rate of the Saudi rial against the Russian ruble over the past 180 days as of January 15, 2011, the exchange rate of the Saudi rial fluctuated in the range from 8.3912 rubles per rial to about 7.9 rubles per rial (see Fig. 22 ) .

Fig.22.

Dynamics of change in the ratio of the exchange rate of the Saudi rial to the Russian ruble.

Source:

Saudi Arabian Monetary Agency (SAMA) revenue as of June 30, 2009 according to the profit and loss account amounted to 3.042 million rials. Among the expenses, the largest share was made by the contributions of the Saudi Arabian Monetary Agency SAMA to the Public Pensions Agency (see Table 66) .

Table 66

Saudi Arabia Monetary Agency (SAMA) Income Statement as of June 30, 2009 (million rials)

As shown by the dynamics of changes in the financial position of the Saudi Arabian Monetary Agency (SAMA) since 2005. to 2010 (first quarter), in general, there was an increase in assets. The largest share in the assets was occupied by investments in foreign securities, which also had an increasing dynamics. Among liabilities, the largest share belonged to government deposits (see Table 67).

Table 67

Dynamics of changes in the financial position of the Saudi Arabian Monetary Agency (SAMA), data at the end of the year, million rials

|

Commitments |

||||||

|

Issue of banknotes |

||||||

|

Government deposits |

||||||

|

Deposits of commercial banks |

||||||

|

Deposits of foreign |

||||||

|

organizations in rials |

||||||

|

Other obligations |

||||||

|

Deposits in foreign |

||||||

|

Investments in foreign |

||||||

|

securities |

||||||

|

Other assets |

||||||

Source: .

In 1971 The Public Investment Fund (PIF) of Saudi Arabia was established. Its purpose was to contribute to the development of the national economy of Saudi Arabia. In 1974 The Public Investment Fund (PIF) received the authority to place assets in shares of joint ventures of the national economy.

The Public Investment Fund (PIF) is managed by the Ministry of Finance of Saudi Arabia. April 15, 2008 The creation of a new sovereign wealth fund for Saudi Arabia, Sanabil al-Saudia, was announced with a capital target of $5.3 billion (20 billion riyals). The management of the fund is supposed to be entrusted to an investment company wholly owned by the Public Investment Fund. The purpose of the fund is to diversify the country's financial assets and improve investment risk management, as well as diversify the country's economy through the development of its financial services sector. The creation of the Sanabil al-Saudi fund was preceded by the following events (see Table 68):

The possibility of creating a sovereign wealth fund is connected with the development of the country's economy. In 2009, the Saudi Arabian economy continued to grow despite unfavorable global conditions and the financial crisis, which resulted in a significant decline in oil prices during the year. There was also a decline in prices, including a decline in the price of oil. According to OPEC, the average price of Arabian Light fell by 35.2% from $94.8/bbl in 2008 (when oil prices were highest) to $61.4/bbl in 2009 (see Table 69). The average daily oil production in Saudi Arabia, according to the Ministry of Oil and Mineral Resources, fell from 9.2 million barrels. per day in 2008 to 8.2 million barrels. per day or by 11.3%. As a result of the decline in prices and production of oil in 2009, GDP at current prices, in which the share of the oil sector is 47.7 percent, fell by 21.2% from 1.8 trillion rials in 2008. up to 1.4 trillion rials in 2009. In constant 1999 prices. GDP increased by 0.6 percent from 836.1 billion rials in 2008 to 841.2 billion rials in 2009. The state budget deficit amounted to 86.6 billion rials or 6.1% of GDP in 2009. In 2008 there was a surplus of 580.9 billion rials or 32.5% of GDP in 2008.

Table 68

Establishment of the Sanabil al-Saudia Foundation

Source: .

The current account of the balance of payments recorded an increase of 85.4 billion rials or 6.1% of GDP in 2009. The monetary aggregate M3 increased by 10.7% to 1028.9 billion rials.

Table 69

The main indicators of the development of the economy of Saudi Arabia in 2005-2009.

|

Index |

|||||

|

Population, million people |

|||||

|

GDP at current prices, billion, rials |

|||||

|

GDP at constant 1999 prices (billion, rials) |

|||||

|

Non-oil GDP deflator |

|||||

|

Inflation rate (consumer prices) |

|||||

|

Aggregate indicator of money supply M3, billion, rials |

|||||

|

Average daily oil production, million barrels |

|||||

|

Arabian Light average oil prices, USD |

|||||

|

Effective exchange rate of the rial (2000=100) |

|||||

|

Index of the ratio of currency in circulation to the total money supply |

|||||

|

Index of the ratio of total deposits to total money supply |

|||||

|

Net foreign assets of national banks, billion, rials |

|||||

|

Interest rates on deposits in national currency, %, for the last 3 months |

|||||

|

Bank capital adequacy index |

|||||

|

Current government revenues, billion, rials |

|||||

|

Current government spending, billion, rials |

|||||

|

Fiscal Deficit Index / Income to GDP |

|||||

|

Export of goods, billion, rials |

|||||

|

Import of goods CIF, billion, rials |

|||||

|

Index of current account surplus to GDP |

|||||

|

Current accounts, billion, rials |

|||||

|

Stock price index (1985=1000) |

Source: .

At the end of 2009, the total share index increased by 27.5 percent over the year from 4803 in 2008 to 6121.8 in 2009. The market capitalization of shares increased from 924 billion rials in 2008 to 1195.5 billion rials in 2009 According to OPEC data, the world spot price of crude oil in 2009 decreased. The average annual price of Arabian Light oil fell from $94.77 per barrel in 2008 to to $61.18 per barrel in 2009, the average annual price of Dubai oil fell from $93.48 per barrel in 2008 to to $61.65 per barrel in 2009, the average annual price of North Sea Brent oil fell from $97.01 per barrel in 2008 to $61.5 per barrel in 2009, the average annual price of North Sea Brent oil West Texas

Intermediate dropped from $99.63/bbl in 2008 to $61.66/bbl in 2009. the average price of Arab Light oil rose from $42.9 per barrel. for the same period in 2009. up to 75.75 dollars per barrel. or by 76.6% (see Table 70), Fig. 23.

Average annual spog prices for types of oil in 1995 - 2010 US dollars per bbl.

Table 70

|

North sea (Brent) |

||||

|

Source: .

Fig.23.Dynamics of changes in various grades of oil in the period from 1995 to 2010 Source: .

Real crude oil prices were declining in 2009. The average Arab Light oil price fell 36.4 percent from $16.31/bbl in 2008 to $10.38/bbl in 2009; the average North Sea Brent oil price fell 37.5 percent from $16.69 per barrel in 2008 to $10.43 per barrel in 2009 (see tab. 71). Over the past 5 years, the real price of Arab Light oil reached its highest level in 2008 ($16.31 per barrel). The lowest level was observed in 2005. and amounted to 9.31 dollars per barrel.

Nominal and real prices for types of oil (by 1970),

dollars / barrel