Bank account according to the chart of accounts. Chart of accounts for accounting of credit institutions

Structure of the Chart of Accounts in Credit Institutions

Accounting records in banks are kept according to the Chart of Accounts established by the Bank of Russia. Since January 1, 2013, the Chart of Accounts has been in force, approved by Regulation No. 385-P, which is the national standard for credit institutions. Based on the Chart of Accounts accounting credit institutions are based on the experience of the domestic banking system of Russia, taking into account the requirements international standards. Consultants from the International Monetary Fund and representatives of the World Bank took part in the development of the concept, but the Bank of Russia carried out the bulk of the work independently, taking into account the peculiarities and uniqueness of Russian conditions.

The Chart of Accounts of credit institutions ensures maximum transparency and comparability of reporting, allows for the analysis of the bank's financial statements in terms of such indicators as economic structure, liquidity, solvency and banking risks.

The Banking Chart of Accounts, unlike the Chart of Accounts of the Ministry of Finance of Russia, is mandatory. This is due to the need for an adequate and comparable display of information across the entire banking system.

The Chart of Accounts is based on a hierarchical structure - each subsequent level details the previous one using such features as the form of ownership, the type of organization, the type and duration of the operation.

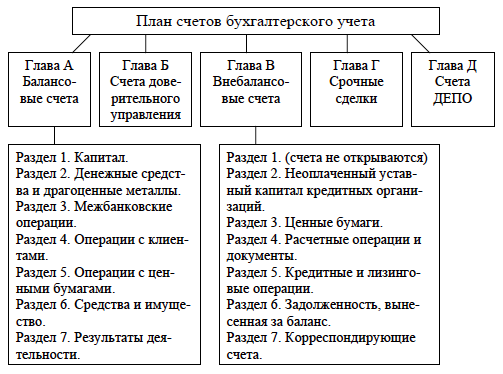

The following structure is adopted in the Chart of Accounts: chapters, sections, subsections, first-order accounts, second-order accounts, personal accounts of analytical accounting. Chart of accounts of credit institutions has five chapters, which reflect the specific information model of the credit institution.

Chapter A. Balance sheets.

Chapter B. Trust management accounts.

Chapter B. Off-balance sheet accounts.

Chapter G. Derivative financial instruments and forward transactions.

Chapter D. Depo accounts.

Separate local balance sheets are compiled for each chapter. Accounts are opened by sections and are of the first order (three-digit) and the second order (five-digit). The accounts of the first order indicate the number of the section and its economic content of the balance sheet items, and the accounts of the second order reveal the content of the accounts of the first order.

Sections of chapters and accounts, in accordance with the requirements of IFRS, are arranged as the liquidity of assets, capital and liabilities decreases. The chart of accounts of banks contains approximately 1200 accounts of the second order. Account numbering allows you to enter additional account numbers.

In the Chart of Accounts, there are so-called paired accounts, for which the balance can be reversed. It is allowed to have a balance on only one personal account from an open pair: active or passive. At the beginning of the trading day, operations begin on personal account having a balance (balance), and in the absence of a balance - from an account corresponding to the nature of the operation. If at the end of the working day a balance (balance) is formed on the personal account, opposite to the attribute of the account, i.e. on a passive account - debit or on an active account - credit, then it must be transferred by accounting entry on the basis of a memorial warrant to the corresponding paired personal account for accounting for funds. If for some reason there are balances (balances) on both paired personal accounts, then at the end of the working day it is necessary to transfer the smaller balance to the account with a larger balance by accounting entry on the basis of a memorial order, bearing in mind that at the end of the working day there should only be one balance: either debit or credit on one of the paired personal accounts.

End-of-day education in Debit Accounting by passive account or credit on an active account is not allowed. However, in some cases, a credit institution accepts documents from customers to debit funds from their current accounts in excess of the funds available to them. Since in this case there is an operation of crediting the client's account (overdraft), the resulting debit balance at the end of the day is transferred from current accounts to accounts for recording loans granted to customers. Such operations are carried out if it is provided for in the bank account agreement.

Another feature of the bank Chart of Accounts. There is no special section on accounting for foreign transactions. Accounts in foreign currency are opened on any accounts of the Chart of Accounts where transactions in foreign currency can be recorded. At the same time, transactions in foreign currency are recorded on the same second order accounts on which transactions in rubles are recorded, with the opening of separate personal accounts in the respective currencies. (Example: 40702 810 000100005235 and 40702 840 000100005235.) The number of a personal account opened to record transactions in foreign currency and precious metals shall include a three-digit code of the corresponding foreign currency or precious metal in accordance with the All-Russian Classifier of Currencies (OKB). Analytical accounts in foreign currency may be maintained by decision of the credit institution in rubles at the exchange rate of the Bank of Russia and in foreign currency or only in foreign currency.

All banking operations performed by credit institutions in foreign currency must be reflected in the daily balance sheet only in rubles. For additional control and analysis of transactions in foreign currency, credit institutions are allowed to develop special programs and accounting registers.

Consider the characteristics of the chapters and sections of the Chart of Accounts in credit institutions.

Topic 1. Fundamentals of the organization of accounting in banks

The basis for the construction of accounting in banks is a single system of accounts synthetic accounting, i.e. "Chart of Accounts for Accounting in Credit Institutions of the Russian Federation". The chart of accounts is used to reflect the bank's own and borrowed funds and their placement in credit and other active operations. The chart of accounts was developed on the basis of the Civil Code of the Russian Federation, federal laws of July 10, 2002 No. 86-FZ "On the Central Bank Russian Federation(Bank of Russia)", dated December 2, 1990 No. 395-1 "On banks and banking activities", using international accounting standards.

The chart of accounts for banks has been developed taking into account the accumulated experience of the banking system in our country, the established practice of banking accounting in foreign countries.

When developing the Chart of Accounts, the following accounting principles were taken into account:

1. Business continuity.

This principle assumes that the bank will continue to carry out its activities in the future.

2. Constancy of accounting rules. Banks should always be guided by the same accounting rules, except in cases of significant changes in their activities or legal mechanism. Otherwise, comparability with reports of the previous period must be ensured.

3. Caution.

Assets and liabilities, income and expenses should be estimated and reflected in accounting reasonably, with a sufficient degree of caution, so as not to transfer existing risks that potentially threaten the bank's financial position to subsequent periods.

4. Reflection of income and expenses on a cash basis.

The principle means that income and expenses are included in the accounts for their accounting after the actual receipt of income and expenses.

5. Day of reflection of transactions.

Transactions are recorded in the accounting records on the day they are performed (documents are received), unless otherwise provided by Bank of Russia regulations.

6. Separate reflection of assets and liabilities. Under this principle, asset and liability accounts are valued separately and presented on a gross basis.

7. Continuity of the incoming balance.

The balances on balance and off-balance accounts at the beginning of the current reporting period must correspond to the balances at the end of the previous period.

8. Priority of content over form. Transactions are recorded according to their economic substance and not according to their legal form.

9. Unit of measure.

Assets and liabilities are carried at their historical cost at the time of acquisition or incurrence. The initial cost does not change until they are written off, sold or redeemed. Assets and liabilities in foreign currencies, precious metals and stones must be revalued as the exchange rate and metal price change in accordance with the regulations of the Bank of Russia.

10. Openness.

Reports should faithfully reflect the bank's operations, be understandable to an informed user, and avoid ambiguity in reflecting the bank's position.

11. A credit institution must draw up a consolidated balance sheet and reporting for the bank as a whole. The daily balance sheets used in the work of the bank are compiled according to the accounts of the second order.

12. Valuables and documents reflected in balance sheet accounts are not reflected in off-balance sheet accounts.

Accounts of the nomenclature of the bank's balance sheet are divided into balance and off-balance. Accounts can be active and passive. Balance and off-balance accounts are built on the principle of one-way grouping - accounts of any type can be present in one section.

Active balance accounts include: cash on hand at the bank, short-term and long-term loans, capital investment costs, receivables, other assets and diverted funds.

Passive balance sheet accounts reflect: bank funds, funds of organizations and individuals, deposits, funds in settlements, bank profit, accounts payable, other liabilities and borrowed funds.

Funds in passive accounts are the bank's resources for lending and financing the organization, and debt in active accounts shows the use of these resources.

All accounts of the Chart of Accounts are divided into:

Accounts first order - enlarged;

Accounts second order - detailing.

First order balance accounts are designated by three digits from 102 to 705. Second order accounts consist of five digits and are constructed by adding two digits to the right of the first order account number. For example, account 202 "Cash currency and payment documents", account 20202 "Cash desk of credit institutions", account 20203 "Payment documents in foreign currency", account 20206 "Cash desk of exchange offices", etc.

On the accounts of the second order, defined by the "List of paired accounts for which the balance can be reversed", paired accounts are opened. It is allowed to have a balance on only one personal account from an open pair: active or passive. At the beginning of a trading day, operations begin on a personal account with a balance, and in the absence of a balance, from an account corresponding to the nature of the operation. If at the end of the working day a balance is formed on the personal account that is opposite to the attribute of the account, then it should be transferred by accounting entry on the basis of a memorial order to the corresponding paired personal account for accounting funds.

If, for some reason, balances have formed on both paired personal accounts, then at the end of the working day it is necessary to transfer the smaller balance to the account with a larger balance on the basis of a memorial order. It should be remembered that at the end of the working day there should be only one balance: either debit or credit on one of the paired personal accounts.

Off-balance accounts are used to account for valuables and documents that do not affect the asset and liability of the balance sheet, received by the bank for storage, collection or commission. Payment signs are also taken into account state duty, strict reporting forms, shares, other documents and valuables.

Off-balance accounts according to economic content are divided, like balance ones, into active and passive. Operations are recorded in accounting using the double entry method: active accounts correspond with account 99999, passive accounts correspond with account 99998, while accounts 99998 and 99999 are maintained only in the currency of the Russian Federation - in rubles. double entry can also be carried out by transferring amounts from one active off-balance account to another active account or from one passive account to another passive account. When revaluing balances on off-balance accounts due to changes in foreign exchange rates against the currency of the Russian Federation - the ruble, active off-balance accounts correspond with account 99999, passive ones - with account 99998.

Off-balance sheet accounts are subdivided into accounts first order - consolidated and accounts of the second order - detailing.

When developing the Chart of Accounts, the following structure was adopted: sections, first-order accounts, second-order accounts, personal accounts of analytical accounting.

Account numbering allows, if necessary, to enter additional personal accounts in the prescribed manner.

Mandatory approval by the head of the bank is subject to a working chart of accounts for accounting in banks, its branches and subordinate institutions, based on the Chart of Accounts approved by the Bank of Russia. It should indicate the list of second-order accounts used in this bank. In the Working Chart of Accounts, it is necessary to indicate on which second-order accounts sub-accounts are opened, and provide a list of all sub-accounts for the corresponding second-order accounts.

The specifics of the operation of such accounts in banking institutions are noticeably different, their numbers do not always coincide, and this also applies to the number of characters. And such concepts as: urgent financial transactions, trust management are present only in the accounting of public and private credit organizations.

In addition to active and passive accounts, until the beginning of 1998, banks had active-passive accounts, which can simultaneously consist of a debit and credit balance. Their elimination further strengthened the isolation of the areas of banking accounting.

Main Account Maintenance Methods

It should be noted that any accounting cannot fully perform its functions without the presence of these. Therefore, it became necessary to introduce an extensive group of accounts, which, in terms of their functional significance, are not inferior to active-passive accounts. These accounts are called paired, they operate on the same principle, and also have the same name.

Paired accounts refer to detailed personal accounts of the second order. The main difference is that the balance on them can change in the opposite way. Some of these accounts are:

- Settlements with other creditors (passive) - 60322

- Settlements with other creditors (active) - 60323

Thus, accounting in banks is able to solve not only the main tasks of forming and registering its activities, but also to help in making management decisions.

Noticed an error? Select it and click Ctrl+Enter to let us know.

Write your question in the form below

The balance sheet of a commercial bank characterizes in monetary terms the state of its resources, the sources of their formation and directions of use, as well as the financial performance at the beginning and end of the period (day, month, quarter, year). Since 1998, new accounting rules and a new chart of accounts for commercial banks and credit organizations have been in force in the Russian Federation.

The chart of accounts of a commercial bank and a credit organization is divided into 5 sections: A; B; IN; G; D.

Section "A" is the main balance sheet of the bank, which reflects its banking resources, the directions of their investment, the bank's property and the financial results of its activities. The balance sheet accounts of the bank are grouped in turn into the following sections:

Section 1 Capital and Funds

Section 2 " Cash and precious metals"

Section 3 "Interbank transactions"

Section 4 "Customer Dealings"

Section 5 "Transactions with securities"

Section 6 "Funds and property"

Section 7 Performance Results.

Section "B" of the Chart of Accounts of a credit organization is a trust management (trust) account. They take into account the funds of clients transferred to the bank under the terms of a trust agreement for management. These funds are the capital of the founders of the trust and can be in the form of cash, securities and precious metals, and other property. Accounts "B" also reflect operations and settlements with funds transferred for management and financial results of the trust.

Accounting for the trust management operation is kept separately from the main balance "A". All trust management operations are performed only between accounts "B" and within these accounts.

A separate balance sheet is drawn up for trust management operations. Thus, the resources of the trust management are not mixed with the resources of the main bank balance "A". This is done in order not to expose the trustees' capital to general banking risks, so that the funds of the trust's clients do not reflect the risks of other banking operations.

Section "B" includes off-balance sheet ("off-balance sheet") accounts, which are grouped into the following seven sections:

Unpaid authorized capital of credit institutions;

Securities;

Settlement transactions and documents;

Credit and leasing operations;

Debt written off and taken off the balance sheet due to the impossibility of collection;

Sources of financing of capital investments.

Off-balance accounts "B" take into account the movement of valuables and documents received by the bank for storage, collection, commission, as well as forms of strict reporting, forms of securities. These accounts take into account collateral for credit operations (securities, received guarantees, precious metals and other property); fixed assets transferred for financial lease (leasing). In addition, accounts “B” include debts of borrowers written off from the main balance due to the impossibility of collecting them.

Section "G" keeps records of urgent transactions, i.e. transactions of purchase/sale of various financial instruments (precious metals, securities, foreign currency and cash), for which the date of settlement does not coincide with the date of conclusion of the transaction. Futures transactions include REPO transactions, forwards, futures, options, etc. These transactions are accounted for on G accounts from the date of conclusion to the settlement date. Accounts of section "G" - off-balance sheet (ie, there is no real cash flow yet). On the settlement date, accounting for the transaction on off-balance accounts "G" is terminated with its simultaneous reflection already in accordance with the actual cash flow on balance accounts. On accounts "G" transactions are divided into:

Cash (with a due date no later than 2 banking days from the date of the transaction);

Urgent (with execution more than 2 banking days);

REPO transactions.

REPO transactions include transactions for the sale of securities with the obligation of subsequent redemption after a certain period at a predetermined price (at the time of the conclusion of the transaction).

Banks, in accordance with the license of the Federal Service for Financial Markets, engage in depositary activities, i.e. activity on accounting and storage of securities of its clients. Section "D" of the Chart of Accounts of Credit Institutions is designed to record operations in bank depositories. REPO accounts reflect depositary operations with securities transferred to the bank by its customers:

For storage and accounting;

For the implementation of trust management (trust);

To carry out brokerage operations;

for other operations.

This section records only those securities that are issued under Russian law: shares, bonds, government bonds, etc. DEPO accounts do not reflect operations with negotiable ("transferable") securities (bills, checks), as well as with deposit and savings certificates. A separate balance sheet is drawn up for DEPO accounts. The Chart of Accounts of Credit Institutions, in force since 1998, brought Russian accounting standards in banks closer to international standards.

Banking accounts are intended for grouping and current accounting of homogeneous banking operations. A certain account is opened for each type of funds and sources of their formation.

Banking accounts can only be active and passive, or without an account sign.

Active accounts are designed to account for the bank's funds in terms of their composition and placement, and its expenses. Passive accounts are designed to account for the sources of funds for their intended purpose, or accounts payable, bank income. The rules for recording accounts are shown in Figures 1 and 2.

Accounting accounts that do not have an account sign are introduced to control the timely reflection of transactions to be completed during the business day. As of the end of the day, there should not be any account balances in the daily balance without specifying the sign of the account.

Figure 1 - Scheme of an active account

Figure 2 - Scheme of passive account

The chart of accounts does not provide for active-passive accounts. To reflect transactions for which the balance can be debit or credit, paired accounts are intended. One is active, the other is passive. It is not allowed to form at the end of the day a debit balance on a passive account or a credit balance on an active one.

The record of operations on paired accounts at the beginning of a trading day begins with the account that has a balance based on the results of the operations of the previous day, and in the absence of a balance, from the account corresponding to the nature of the operation. If at the end of the working day a balance is formed on the personal account that is opposite to the sign of the account, that is, on a passive account - debit or on an active account - credit, then it must be transferred by an accounting entry on the basis of a memorial order to the corresponding paired personal account for accounting funds. If for some reason there are balances on both paired personal accounts, then at the end of the working day it is necessary to transfer the smaller balance to the account with a larger balance by the book entry on the basis of a memorial order, bearing in mind that at the end of the working day there should be only one balance: either debit or credit on one of the paired personal accounts.

Balance sheet and off-balance sheet bank accounts

Bank accounts are divided into balance sheet And off-balance sheet.

Balance accounts are designed to record property, liabilities and financial results.

Off-balance accounts are designed to account for documents and valuables associated with unpaid authorized capital, collateral for bank operations, written-off debt, as well as for accounting for valuables and documents received by the bank for storage, collection, commission, etc.

Bank accounts are divided into accounts of the first and second order.

Accounts of the first order are enlarged, synthetic and consist of three digits.

Accounts of the second order are detailed, opened in the development of accounts of the first order and consist of five characters. For example, account 202 “Cash currency and payment documents” is a first-order account. Within the framework of this account, second-order accounts are opened:

20202 "Cash desk of credit institutions";

20203 "Payment documents";

20206 "Cashier exchange offices»;

20207 "Cash in operating cash desks located outside the premises of banks";

20208 "Cash in ATMs".

Analytical accounts are personal accounts of clients and consist of twenty characters. Numbering scheme for analytical accounts:

- digits from 1 to 5 - balance sheet account of the second order;

– digits from 6 to 8 – currency code;

– bit 9 – security key;

- digits from 10 to 13 - the number of the branch, branch (structural unit) of the bank;

- digits from 14 to 20 - the serial number of the personal account.

Chart of Accounts

IN Chart of Accounts credit institutions adopted the following structure: chapters, sections, subsections (Figure 3)

Figure 3 - The structure of the Chart of Accounts for accounting in credit institutions