Open a card account in a savings bank. Opening a personal account in Sberbank

Any Russian citizen can apply to Sberbank to open an account. Opening an account with Sberbank involves opening a passbook or a plastic card in the name of an individual, in order to further manage this account. You only need to present your passport and state the purpose for which you are opening an account.

passbook

Yes, this, to some extent, banking archaism still exists, but is gradually being replaced by plastic cards. The older generation, our grandparents, who simply cannot use ATMs, are more accustomed to using passbooks. For them, as before, the passbook is a symbol of stability and reliability.

In addition, there are types of transactions that can only be carried out through a passbook. A passbook is issued in the following cases:

- for issuing loans;

- payment of pensions and social benefits;

- upon receipt of funds without deduction of commission from legal entity;

- when opening a deposit for an impressive amount.

The cost of opening a passbook is 10 rubles. The main inconvenience of its use is the territorial separation of bank branches. If a Sberbank client wants to make an intrabank transfer from one region to another, a commission will be charged from him. Also, in a region other than the region of opening an account, you will be able to provide information on it, perform operations only on a special application. Such applications will not be processed immediately, but after a few days, or even weeks.

A plastic card

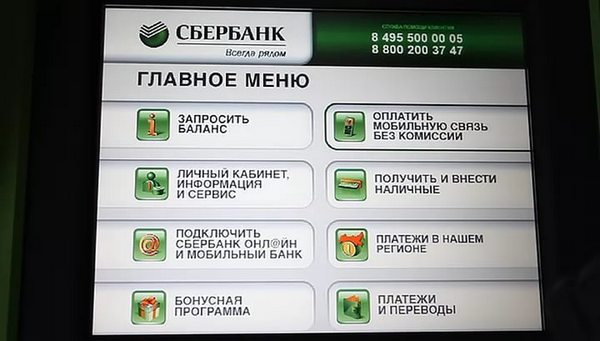

The current generation prefers plastic cards - they are convenient, they require self-service for many operations. For example, you can replenish and withdraw money without commissions through a Sberbank ATM, and not in a specialist window. Please note that when using an ATM of another bank, a commission will be deducted from your card.

It is clear that the card can be used to pay in shops, hotels, airports, cafes, restaurants and other institutions. This is convenient - you do not need to count out a trifle and carry more or less large amounts with you. If the card is stolen or lost, it can be instantly blocked by phone hotline jar. You can control plastic expenses online, through the Internet bank. You can use the card in any region of the country without restrictions and commissions.

The commission for using the card depends on its category, it can be from 0 to 3000 rubles per year. Cards are debit (settlement), salary, credit.

Account opening

You apply to Sberbank with your passport. Any adult citizen can open an account. From 18 to 25 years old, a special student card is opened. Before reaching the age of 18, you can open an account with the consent of the parents.

A bank employee will offer the most convenient interaction program. Together with the employee, an agreement is drawn up for the provision of banking services.

The passbook is issued to the client immediately, the plastic is made for up to 3 weeks. The book is valid for 10 years, the card - 3 years. Reissue after the expiration of the card is carried out automatically and does not require your application. If you change your passport data and place of residence, you should contact the bank branch.

Today, almost every one of us has our own account in some financial institution, or even more than one. How to open a personal account in Sberbank? The answer to this question depends on your status.

If you have reached the age of majority, nothing prevents you in one of the largest banks in the country. To do this, you just need to visit the nearest branch of Sberbank with your passport. Please note that in the future you will resolve all possible issues in this branch, so you should not “start relationships” with an office that will be inconvenient for you to get to.

Contact a specialist and tell us for what purposes you want to open an account. You will be prompted best option and enter into a service agreement with you. Of course, the contract should be read before signing, not at home. After the account is opened, you can start using it - accept transfers from other persons, deposit cash in the bank's cash desk, and so on.

For minors

You can, but keep in mind that you will not be able to withdraw funds from it. Accounts opened for children become available for debit transactions only after their owners reach the age of majority.

In addition to the contract, a passbook or a plastic card will be attached to your account. Cards are much more convenient to use, because they allow you to perform various operations independently and in any locality countries. But the paper book is tied to the department in which you concluded the contract. Its advantage is that the funds on it are safer than on the card, which scammers can use.

For IP

Not everything is so simple for those who are registered as IP. Although opening a personal account with Sberbank is not mandatory requirement for individual entrepreneurs, it is still convenient to have it for non-cash transactions. So, to open a personal account, you will need a whole list of papers:

Not everything is so simple for those who are registered as IP. Although opening a personal account with Sberbank is not mandatory requirement for individual entrepreneurs, it is still convenient to have it for non-cash transactions. So, to open a personal account, you will need a whole list of papers:

- your registration certificate;

- bank statement;

- certificate of tax registration;

- your passport and its copy;

- a license, if it is needed for your type of activity;

- special cards with sample signatures of authorized persons and seal imprints.

If everything is in order with the papers, then after a few days allotted for verification, your account will be opened.

Legal entity

For not a luxury, but a necessity. Moreover, banks do not provide this service for free: a monthly fee is charged for the service. And there will be a lot of documents to collect.

The presence of a current account is a prerequisite for the implementation of the activities of individual entrepreneurs, legal entities. Choosing a bank to open it is a responsible task, therefore the services of Sberbank as a reliable and state-supported organization are most in demand.

Package of documents when opening a current account individual entrepreneur includes:

- cards containing examples of signatures of the head and his proxies, seals - it is permissible to certify them directly at the bank;

- a power of attorney to confirm the authority to conduct transactions with the finances of the employees listed in the card, duly certified;

- passport;

- TIN certificate;

- IP registration certificate;

- licenses (if necessary);

- application for opening a checking account.

In order not to waste time, it is preferable to prepare the papers in advance. They are brought to the bank branch and transferred to an authorized employee. He will accept and check the documents, and then transfer them to the accounting or legal services for examination.

After carrying out all the necessary checks, which will require several days of work, Sberbank opens an account for an individual entrepreneur, who is assigned a specific number. Then it is important to timely perform the mandatory actions to provide information to government agencies:

- tax service;

- Pension Fund of the Russian Federation;

- branch of the FSS (if necessary: when there is registration, employees).

Important! Information is provided in the manner prescribed by law within a week.

Obligations of Sberbank of Russia when maintaining an IP account

Opening an account with Sberbank involves the conclusion of an agreement on settlement and cash services. According to this agreement, the bank assumes obligations to the individual entrepreneur and receives some rights.

- Sberbank undertakes to make payments on time in accordance with regulatory documents, ensure the safety of the client's funds, keep commercial secrets about his financial transactions, including after the termination of the contract.

- Sberbank has the right to monitor all payments made without exception and evaluate their rationality.

- Entrepreneur has the right to demand the closure of the current account and issue the balance of funds at any time.

For the production of money transfers, registration of financial actions, payment orders are used, which indicate information about the purpose of the payment.

Opening an account with Sberbank for a legal entity

The list of documents for opening a current account with Sberbank for a legal entity includes:

- Charter and other constituent papers of the company;

- OGRN certificate;

- TIN certificate;

- papers testifying to the authority of the director of the company;

- cards with lists of persons who have been given the right to make financial transactions on the company's account, examples of their signatures, information about its owner, including contact details, and a seal imprint;

- papers testifying to the powers of the persons listed in the card.

In the general case, the director (the right of the first signature) and the accountant (the right of the second signature) have the opportunity to perform operations with funds on the account. In relation to persons whose authority includes maintaining an account, it is required to provide papers confirming the position held.

To successfully complete the identification procedure that Sberbank performs before opening an account for a legal entity, you will need the following data:

- full name of the organization;

- organizational and legal form;

- TIN certificate;

- company registration certificate;

- information about authorized employees;

- the size of the authorized capital;

- postal and legal address of the organization;

- information on the frequency of stay of the company's employees at the registration address;

- licenses;

- information about the company's bodies;

- scroll phone numbers for contact.

Successful verification of papers ends with the opening of a current account, about which a corresponding entry is made in the registration book. Within a week, the tax department must be notified of the incident by the legal entity in the manner prescribed by law.

Opening an account with Sberbank for an individual

Opening an account at a branch of Sberbank is available to any capable citizen. It can be linked to a savings book or a plastic card, which act as money management tools. The contract is concluded in a standard form, it contains the data of both parties and information on the account.

The passbook is issued immediately for a period of 10 years, after which it must be replaced, or the current account is closed. You will need to wait for the finished plastic card, it is made within 21 days (nominal options), for its issuance, you will need to go to the bank branch with a passport.

A personalized card has a validity period of 3 years, after which the bank reissues and sends a new one to the same branch. Sberbank monitors compliance with the deadlines on its own, the rules require that from the moment the validity period ends old map before the arrival of a new one, no more than 14 days passed.

An individual with whom an account maintenance agreement has been concluded must receive an updated card within 6 months, otherwise its action will be paused. Bank employees will search for the client according to the information and contacts at their disposal, however, in case of failure, the card will be destroyed.

An individual with whom an account maintenance agreement has been concluded must receive an updated card within 6 months, otherwise its action will be paused. Bank employees will search for the client according to the information and contacts at their disposal, however, in case of failure, the card will be destroyed.

To conclude an agreement, it is enough to go to the selected branch with a passport and provide the bank employee with information about the purpose of the application. Knowing the tasks for which an account is opened will help a specialist offer an optimal banking product to an individual.

Important! You should contact the branch of Sberbank where it will be convenient to visit regularly, since it is there that it will be possible to resolve issues that arise in the process of using the account.

Opening an account with Sberbank-online

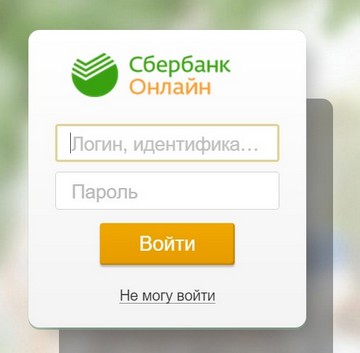

The procedure for opening an account online with Sberbank is not difficult, but you need to go through all its stages without making mistakes.

- An application for connecting the Sberbank service online is accepted at the office by a bank employee who identifies the client's identity using his passport.

- The next step is to sign a universal banking agreement.

- In the absence of a history of cooperation with an individual (when he does not have any Sberbank plastic cards), an instant card is issued for him, which does not require payment for the service.

- If necessary and at the request of the client, the Mobile Bank service is connected for him. This is a paid service provided at an insignificant subscription rate (30-60 rubles per month).

- The client ID with a password is printed in the form of a check through a terminal or ATM and using a plastic card. If the "Mobile Bank" service is activated, all the necessary data comes in SMS messages.

Important! It must be remembered that in case of any difficulties, the client can seek help from a Sberbank employee who is constantly in the hall.

You can perform the necessary actions from your home PC, smartphone or Sberbank terminal with Internet access. From the main page of the company's website, go to the "Individuals" menu, then "Online Services" and "Sberbank Online". To log in to your personal account, you need to enter the identifier and password received during registration in the fields intended for this purpose.

Being in the system, one by one, you need to go through the menu items "Payments and operations", "Deposit operations" and "Opening a deposit". Having carefully read all the sections of the agreement, you should select the deposit and press the "Continue" button. In response to this action, the system will provide an electronic account application form.

Being in the system, one by one, you need to go through the menu items "Payments and operations", "Deposit operations" and "Opening a deposit". Having carefully read all the sections of the agreement, you should select the deposit and press the "Continue" button. In response to this action, the system will provide an electronic account application form.

The card number is filled in so that the funds from it can be transferred to the deposit being created. IN personal account all customer accounts with card data and information about the amount of money on them are visible. With absence required amount it is permissible to transfer it from an account in another bank, for example, to an instant card.

All completed columns should be carefully re-read, confirm agreement with the terms and conditions and submit an application. If it is approved by the bank, then the operation will go into the category of executed and acquire the appropriate status.

Important! It is necessary to perform any actions when carrying out transactions with financial resources, avoiding haste and carefully studying all the terms of the contract.

The cost of Sberbank services

Some of the services provided by Sberbank when opening a current account in the business sector are paid. Estimated cost for Moscow region is:

- opening an account - 5 thousand rubles;

- connecting the remote account management service - 3.5 thousand rubles;

- opening an account for the segment of small businesses with annual revenue up to 1.8 million rubles. in compliance with the conditions for using a credit line in this branch of the bank - 1 thousand rubles;

- maintaining an account through the Sberbank Business Online system - 810 rubles. per calendar month.

The following services are not covered:

- maintaining an account through the Client-Sberbank system;

- maintenance of accounts of non-profit organizations, in accordance with the Charter, assisting the disabled and veterans of the Great Patriotic War;

- ordering statements;

- movement of finances on the client's account;

- the operation of terminating the account at the request of the client.

Account types

There are several main types of accounts that can be maintained at Sberbank branches.

Foreign currency account

Individual. To create a foreign currency account, an individual needs to come with a passport and financial resources to the selected branch of Sberbank and fill out an application form, guided by the provided sample. There is a limit on the minimum amount transferred to the bank, after which the account starts working.

Sberbank accrues interest on the balance of funds on the account. Along with its opening, you can also order a currency card, it is convenient for it to pay for goods in foreign online stores.

Entity. A representative of a legal entity will need to provide copies of the company's constituent documents certified by a notary, certificates of state registration and registration in a single state register, completed application. In the process of filing papers, a card is also filled out containing examples of signatures of employees of the organization who have the right to dispose of funds on the account being opened and an imprint of the seal.

It is permissible to prepare the card in advance by notarizing it, or fill in directly at the branch. To receive and send transfers, the details should indicate the details of a personal transit account corresponding to a currency account opened at a bank branch.

Brokerage account

To open a brokerage account, you must first find out by calling or otherwise in which branch of Sberbank this can be done. As a rule, to receive this service, you need to go to the central office.

The list of papers for applying includes a passport, TIN certificate, card or savings book. About 2 thousand rubles. you will also need to pay for a flash-card with specialized software that allows you to start working by creating purchase and sale orders from a personal computer or by phone.

Important! Brokerage training materials are available on the Sberbank website.

Deposit account

The required deposit account should be selected based on the information contained on the Sberbank website. For an individual you will need to come with a passport (containing a registration mark) - this is enough to write an application for opening an account and sign an agreement.

A representative of a legal entity will need to fill out an application form for accession. The absence of a current account with Sberbank will require the conclusion of a bank account agreement.

Metal account

To create a metal account, you will need to submit a passport and a TIN certificate (if any), then write an application and transfer ingots or funds to an authorized bank employee for their purchase. Signing the contract and receiving a copy of it along with the passbook completes this procedure.

Savings account

To create a savings account, you need a passport and a TIN certificate. The contract is signed after the approval of the application and the transfer to the cash desk of Sberbank of funds in the amount of at least 30 thousand rubles. Replenishment of the account is possible until the agreement expires. At the end of the calendar month, the bank calculates interest.

Important! The client is allowed to choose the currency for opening a savings account at will, or create a multi-currency account.